When you hear "AI' in the financial world," your mind probably jumps straight to high-stakes trading algorithms. It’s the world of giants like BlackRock's Aladdin, where AI is presented as the secret sauce for finding the next sliver of alpha. While that hunt for market-beating returns is a constant, it isn't the whole story.

For most asset management firms, the most immediate and tangible return from AI isn't in predicting the market. It’s found in overhauling the day-to-day work that keeps the lights on.

This guide is about that other side of the coin. It’s a practical look at how AI for asset management is simplifying workflows, strengthening investor relationships, and building a more solid operational backbone. We'll look at how modern AI can be set up in minutes, not months, freeing up your team to focus on what they do best: managing assets and taking care of clients.

What is AI for asset management?

The term "AI for asset management" really covers two different worlds. Figuring out the distinction is the first step toward making a smart investment in the technology.

1. AI for investment decision-making

This is the traditional, and frankly, more hyped-up version of AI in finance. It involves using complex machine learning and quantitative models to forecast market movements, find trading signals, and optimize portfolios. It’s mostly the playground of quant funds and massive institutions with huge R&D budgets dedicated to finding a statistical edge. It's powerful, no doubt, but it's also expensive to build and isn't a magic bullet for generating alpha.

2. AI for operations and client services (What we're focused on)

This is where AI becomes an accessible tool that can help just about any asset management firm, right now. This application is less about predicting stock prices and more about empowering your people. It’s about using AI to automate repetitive admin tasks, make sense of huge amounts of information for your internal teams, and give faster, more personal service to your investors.

| Feature | AI for Investment Decision-Making | AI for Operations & Client Services |

|---|---|---|

| Primary Goal | Generate alpha, predict market movements | Improve efficiency, enhance client experience |

| Key Users | Quantitative analysts, portfolio managers | Relationship managers, operations, compliance |

| Core Tech | Complex quantitative and ML models | Generative AI, chatbots, process automation |

| Typical Cost | Very high R&D and implementation costs | Lower, subscription-based pricing |

| Time to Value | Long-term, high-risk | Short-term, immediate and tangible ROI |

| Main Benefit | Potential for market outperformance | Scalable operations and stronger client relationships |

Think of it as the foundation that lets your investment professionals, relationship managers, and operations staff concentrate on high-value work, like deep research or strategic client conversations, instead of getting buried in administrative tasks.

Improving investor communications with AI

In asset management, strong investor relationships are built on trust and timely communication. The reality, though, is often a scramble. Relationship managers spend hours manually drafting emails, digging through different systems for answers to client questions, and prepping for meetings. It’s a slow process that just doesn't scale as your firm grows.

Generative AI is changing this by turning communication from a manual chore into a much smoother workflow.

Deliver instant, personalized client support

Imagine your investor portal having an expert on call 24/7. AI-powered chatbots can now provide immediate answers to common investor questions like, "What's the latest NAV for Fund X?" or "Where can I find the Q3 performance report?"

But not all chatbots are created equal. Generic bots can give vague or, even worse, wrong answers. A specialized tool is needed here. For example, the eesel AI Chatbot is built for this specific challenge. You can train it securely on your firm’s unique knowledge, fund prospectuses, market commentary, FAQs, and compliance docs, so it provides accurate, on-brand answers. And when a question gets too complicated, it knows to pass the conversation to a human.

Speed up reporting and communication workflows

The routine work of keeping clients in the loop takes up a massive amount of time. AI can now handle the first draft of almost any client communication. It can generate personalized client update emails, summarize call notes into clear follow-ups, and even create talking points for an advisor’s next meeting by pulling info from CRM notes and portfolio data.

This is where an AI assistant that works inside your existing tools really helps. The eesel AI Copilot, for instance, integrates directly into help desks and email. It doesn't just write generic text; it learns from your entire history of past client messages to draft replies that match your firm's specific tone and terminology. This keeps your brand consistent and cuts drafting time from minutes down to seconds.

Automating middle and back-office operations with AI

Behind every great investment team is a small army of operations, compliance, and support staff. Too often, though, their work is slowed down by manual processes and siloed information. Finding a specific compliance rule or an investment memo from last quarter can turn into a frustrating scavenger hunt across a dozen different systems.

A single AI layer can act as the connective tissue for your firm, breaking down those knowledge silos and automating tedious workflows.

Centralize company knowledge for instant answers

It's a problem everyone has: important information is scattered everywhere. It’s in Confluence, SharePoint, Google Docs, research reports, and internal wikis. This fragmentation means your team wastes time just looking for information instead of using it.

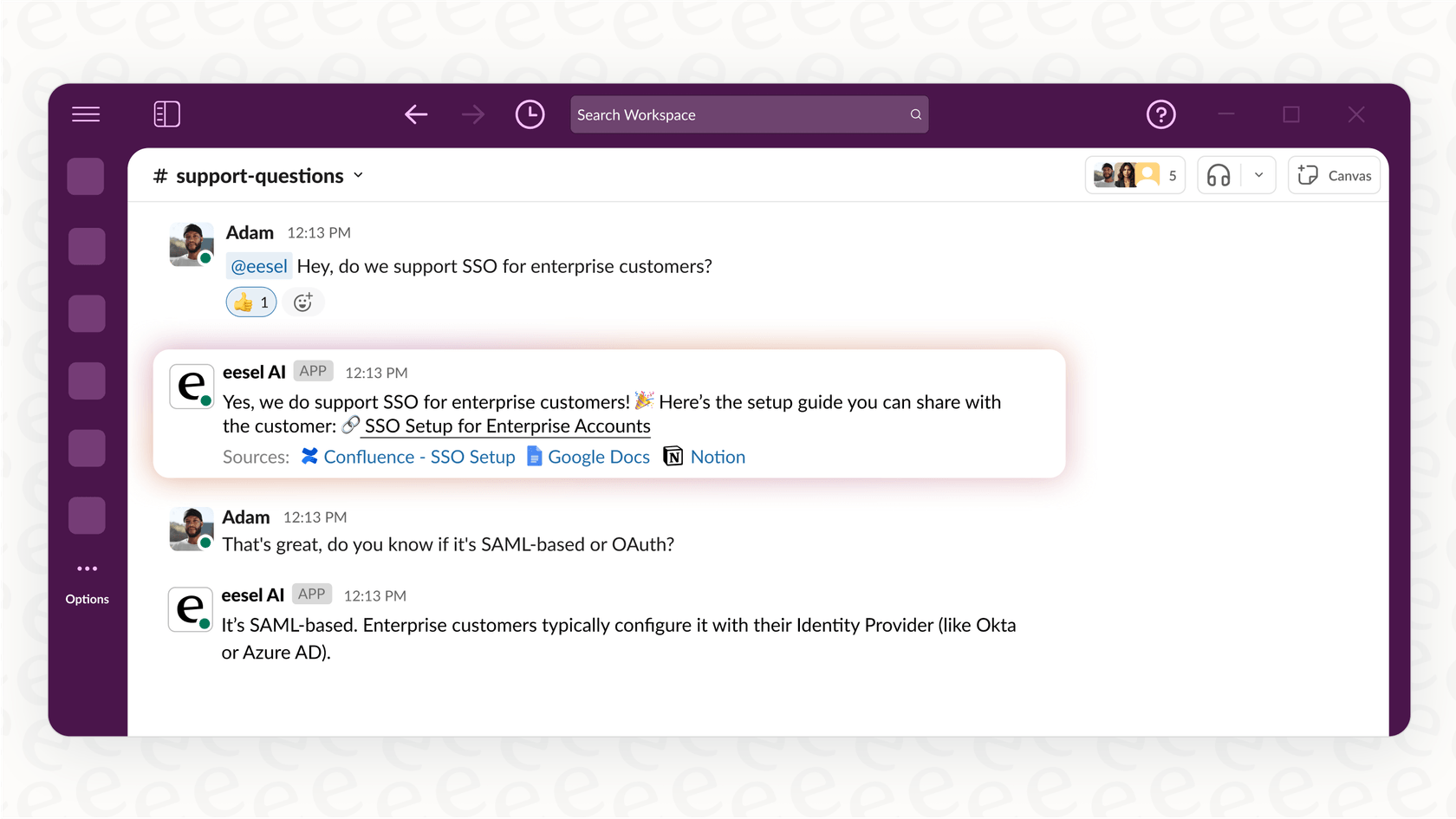

A centralized intelligence layer is the answer. With a tool like eesel AI Internal Chat, you can connect all these different sources into a single, searchable brain for your company. Employees, from legal to portfolio analysts, can ask questions in plain English directly within Slack or Microsoft Teams and get immediate, sourced answers. It's more than a search tool; it's an instant expert that knows where all your institutional knowledge is.

Streamline compliance and operational queries

The same tech can be applied to very specific, regulated functions. For example, AI can do an initial review of marketing materials against a library of compliance checklists, flagging potential issues for a human to look at. It can also handle the flood of internal IT and HR support questions that pull your teams away from their main jobs.

This is where having scoped AI agents is key. With eesel AI, you can build multiple, independent bots for different purposes. You could have a "Compliance Bot" trained only on regulatory documents and internal policies. This ensures it gives answers strictly within its defined knowledge base, preventing it from giving off-topic or speculative advice. This level of control is essential for any firm in a regulated environment.

Choosing the right AI platform

Adopting AI is about more than just technology; it’s about choosing a partner that fits your existing workflows and protects your data without a six-month implementation project. Unfortunately, many "enterprise" AI solutions feel stuck in the past, requiring long sales cycles and complex setups.

Here are a few things to look for when you're evaluating platforms.

Look for rapid, self-service implementation

The old way involves months of consultations and dedicated developers just to get a peek at the product. That model is slow, expensive, and outdated.

Look for platforms that are built for you to use yourself. Your team should be able to set up and configure the tool without needing a team of engineers. With eesel AI, you can connect your knowledge sources, integrate with your help desk or chat tools, and go live in minutes. It's designed for non-technical users to manage on their own, fitting into your current operations without forcing you to rip out systems you already rely on.

Prioritize confident, risk-free testing

Deploying a new AI tool is a big decision. What if it gives a wrong answer to a key investor? Most vendors offer a canned demo that shows a perfect scenario but gives you no real sense of how it will perform with your unique data.

A solid simulation environment isn't a nice-to-have; it's a must. This is another area where eesel AI is different. Its simulation mode lets you test your AI agent on thousands of your actual past client emails or internal support tickets. You can see exactly how it would have responded, giving you hard data on its performance and accuracy before you ever turn it on for real. This lets you deploy with confidence.

Demand unified knowledge and transparent pricing

Many AI tools are surprisingly limited. They can only learn from a single source, like a help center, leaving out the wealth of knowledge in your other documents. To make things worse, their pricing is often a black box. Per-resolution or per-answer fees mean your bill can shoot up during a busy quarter, basically penalizing you for being successful.

Choose a tool that can truly unify your knowledge and offers predictable costs. eesel AI connects to everything from Confluence and Google Docs to your past support conversations, creating a complete brain for your business. Most importantly, its pricing is straightforward. There are no per-resolution fees, so your costs are predictable and you're never surprised by a bill.

The future of AI for asset management is operational excellence

While the quest for alpha will always be the north star of asset management, the biggest competitive advantage in the coming years will be built on a foundation of efficient, intelligent, and client-focused operations.

AI is the key to reaching this new level of performance, but only if firms choose tools that are agile, secure, and built for how modern teams actually work. The winners won't be the firms that just buy into the AI hype; they will be the ones that strategically empower their human experts, automating the administrative grind so they can deliver a superior investor experience.

The right AI platform can be a boost for your entire firm, from the back office to the front lines.

Frequently asked questions

This guide emphasizes that the most immediate value of AI for asset management lies in transforming operations and client services, rather than solely in high-stakes market prediction. It focuses on empowering your teams and streamlining day-to-day workflows.

AI for asset management can deliver instant, personalized client support through trained chatbots that answer common questions securely. It also speeds up reporting and communication workflows by drafting emails, summarizing notes, and preparing talking points for advisors.

In the middle and back office, AI for asset management centralizes fragmented company knowledge, making it instantly accessible for all teams. It can also streamline compliance checks by reviewing materials against rules and automate responses to internal IT and HR queries.

Yes, AI for asset management focused on operations is designed to be highly accessible for almost any firm. It aims to empower existing staff by automating administrative tasks, freeing them to focus on high-value work, regardless of firm size.

Prioritize platforms that offer rapid implementation and self-service capabilities, allowing your team to go live quickly without extensive development. Look for confident, risk-free testing environments and tools that provide unified knowledge across sources with transparent pricing.

A specialized AI for asset management tool ensures accuracy by being securely trained on your firm's specific knowledge like prospectuses and compliance docs. Scoped AI agents can be limited to defined knowledge bases, and complex questions are passed to human experts, maintaining control and compliance.

Share this post

Article by

Stevia Putri

Stevia Putri is a marketing generalist at eesel AI, where she helps turn powerful AI tools into stories that resonate. She’s driven by curiosity, clarity, and the human side of technology.