If you're an insurance leader, you know the pressure is always on. You're trying to find ways to be more efficient, keep costs down, and give customers a great experience in a market that feels more packed every year. It’s a tricky balancing act. Lately, everyone's been talking about generative AI as the solution to everything, but it's easy to get lost in the hype.

The good news is that generative AI is starting to be more than just a buzzword. It's delivering real, tangible value across the entire insurance lifecycle. This isn't about replacing your team; it's about giving them superpowers.

This guide will walk you through the most important generative AI use cases in insurance, break down the common hurdles you might hit when trying to use it, and show you a simple way to get started.

So, what is generative AI in insurance, really?

Let's skip the dense technical jargon. For insurance, generative AI is a type of artificial intelligence that can read, summarize, and create new content from all the unstructured data your business deals with every day. Think about it: long claims reports, customer emails, detailed policy documents, and complex medical records. Generative AI is built to make sense of all that text.

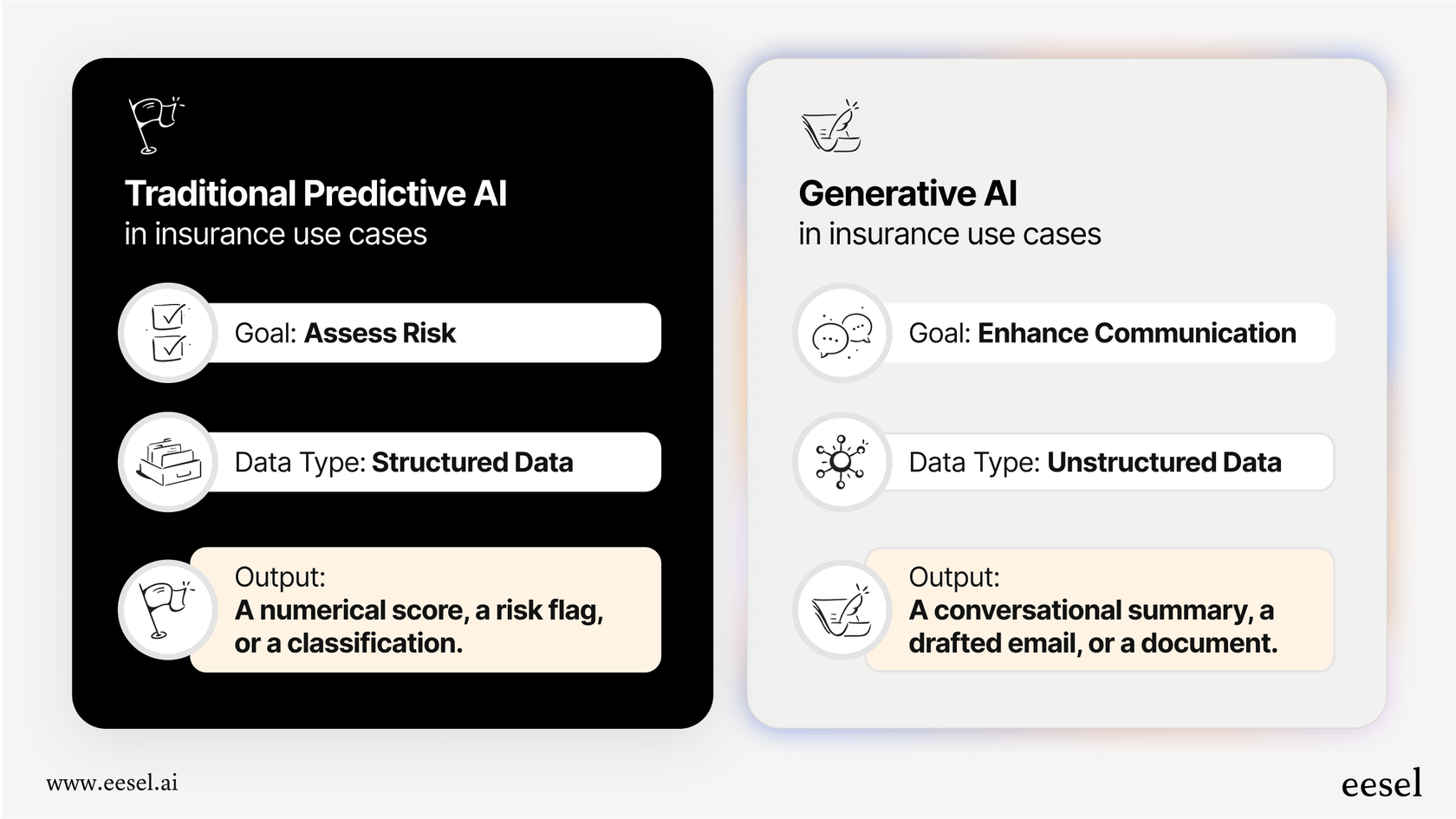

This is a huge leap from the traditional predictive AI the industry has been using for years. While that older AI is great at analyzing structured data (like numbers in a spreadsheet) to calculate risk scores, it can’t read the story behind the numbers. It can flag a claim with a high-risk score, but it can't tell you why based on the adjuster's notes.

Here’s a simple way to look at it: if traditional AI is a super-calculator for risk, generative AI is like an expert assistant who can read an entire case file, grasp the context, and draft a summary for you in seconds. It works with language, not just numbers.

Key generative AI use cases in insurance transforming the industry

The most effective uses of generative AI aren't just one-off tricks. They're solutions that plug into your core operations and make them smarter and faster. Let's look at how it's making a real difference in claims, customer support, underwriting, and fraud detection.

Generative AI use cases in insurance: streamlining claims processing from start to finish

Claims management is full of tedious, manual work that slows everyone down. This is where generative AI can really help. It can automatically read and summarize long accident reports, pull out key details from submitted documents, and even draft the first email to a customer about their claim status. This frees up your adjusters to focus on the complicated parts of their job that require human judgment.

For property and casualty claims, it can even do an initial damage assessment from photos, giving you a head start on estimating costs and getting the claim moving.

But for an AI to handle claims well, it needs the full picture. It can’t just read a help center article; it needs context from past tickets, internal wikis (like your Confluence pages), and policy documents all at once. Many AI tools struggle with this. Modern platforms like eesel AI are built to connect all these scattered knowledge sources, giving the AI the deep context it needs to resolve claims accurately.

Generative AI use cases in insurance: enhancing customer support and engagement 24/7

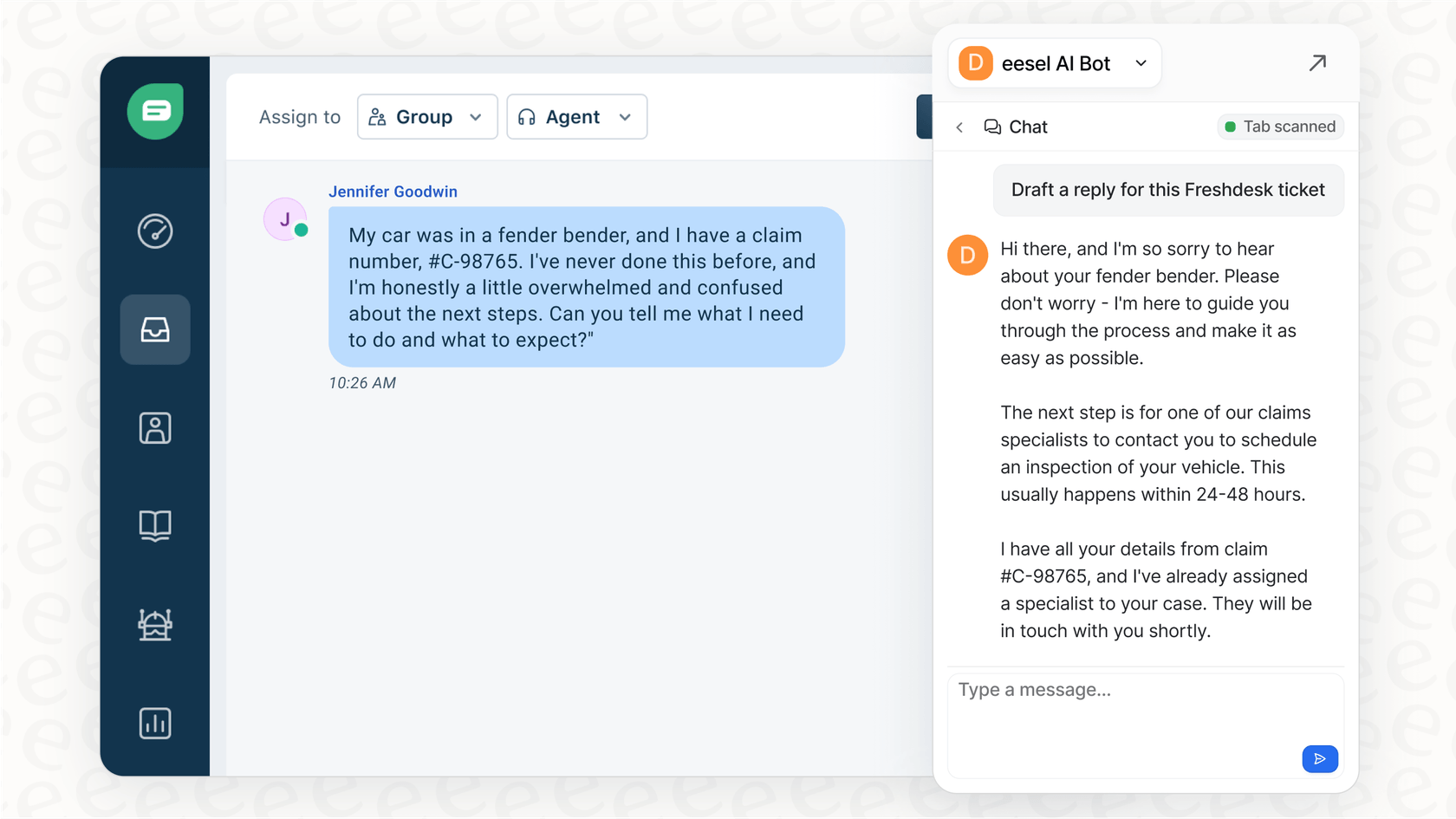

When a policyholder has a question, they want an answer now, not in 24 hours. AI-powered virtual assistants and chatbots can provide instant, accurate answers to common questions about policies, claims, or coverage. They can walk customers through confusing processes step-by-step, any time of day.

More importantly, the best generative AI doesn't sound like a generic robot. By analyzing a customer's history and the tone of their message, it can offer personalized and empathetic responses that make them feel heard.

The goal is to make this tech work for your team, not create more work. You shouldn't have to tear out your existing helpdesk to see the benefits. The best solutions fit right into the tools you already use, like Zendesk or Freshdesk. An AI Agent from eesel AI, for instance, can be set up directly within your current helpdesk. It learns your team's unique brand voice by analyzing thousands of past tickets, making sure every automated interaction feels authentic and helpful.

Generative AI use cases in insurance: improving underwriting and risk assessment

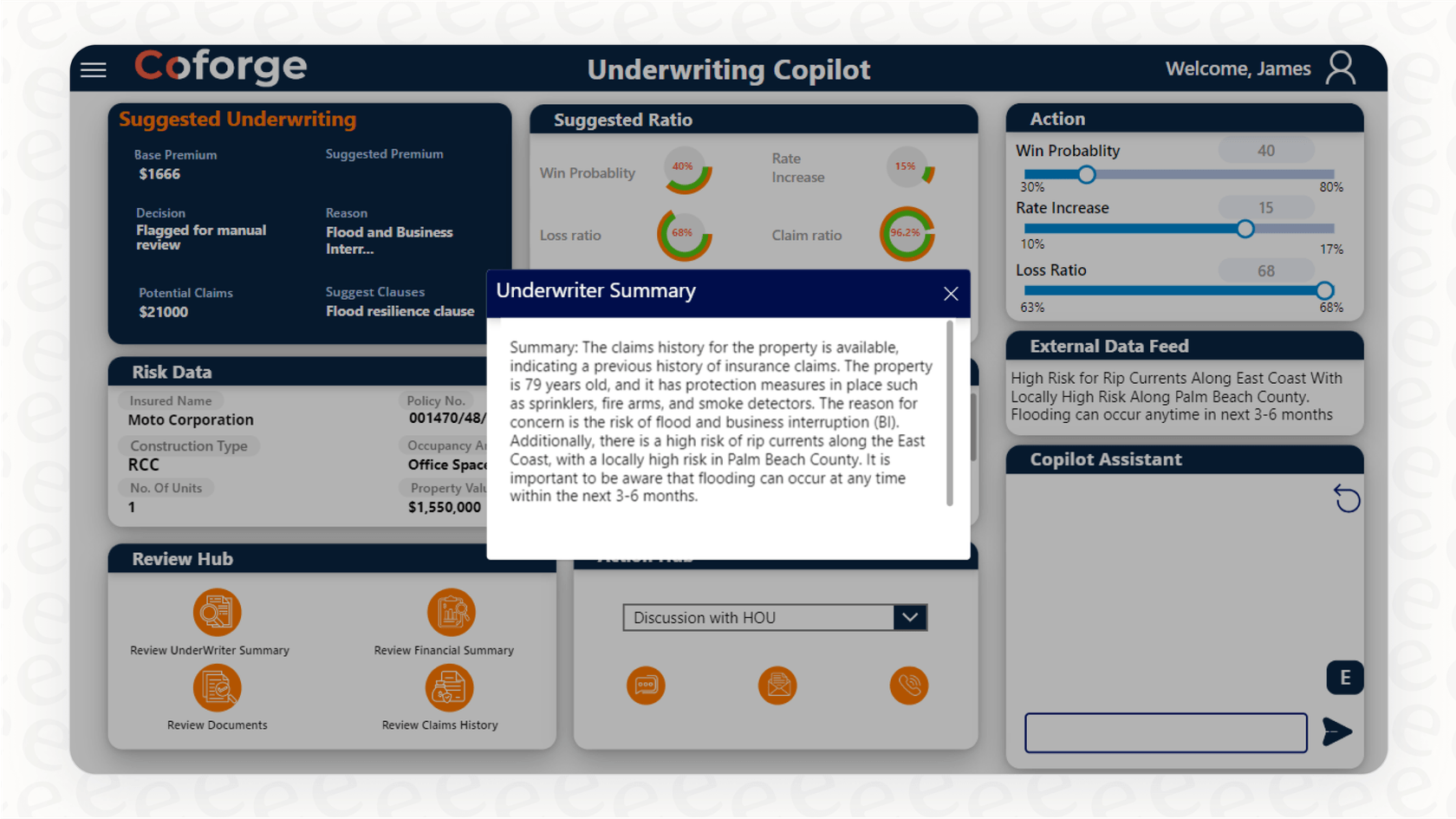

Good underwriting means seeing the whole picture, and that picture gets more complicated every day. Generative AI helps underwriters process huge amounts of unstructured data that go far beyond the usual sources. It can sift through property inspection reports, geological surveys, and even public news feeds to spot new risks that might otherwise go unnoticed.

You can think of it as an "underwriter's copilot." It can take a complex application, summarize it in seconds, flag potential risk factors, and help ensure no critical details are missed. This lets your human experts make faster, more confident decisions. This leads to more accurate pricing and personalized policies that reflect a customer's actual risk, which is better for both the customer and your business.

Generative AI use cases in insurance: detecting and preventing insurance fraud

Insurance fraud is a huge drain on the industry, and those costs get passed down to honest customers. According to the FBI, insurance fraud costs the average U.S. family between $400 and $700 per year in higher premiums. While older systems are decent at catching obvious red flags, they often miss more sophisticated schemes.

Generative AI gives you a new angle to tackle fraud. It's great at spotting subtle inconsistencies and weird patterns in claims data that simple rule-based systems can't see. It can analyze the story of a claim, check it against other cases, and flag things that suggest something isn't right. It thinks more like a seasoned investigator, looking for stories that just don’t add up.

| Feature | Traditional Fraud Detection | Generative AI Fraud Detection |

|---|---|---|

| Data Sources | Mostly structured data | Structured & unstructured data (notes, images) |

| Analysis Method | Fixed rules and known patterns | Contextual understanding & anomaly detection |

| Detection Power | Catches individual, obvious fraud | Identifies sophisticated fraud rings & new schemes |

| Human Interaction | Creates a lot of false positives | Flags tricky cases with higher confidence |

Navigating challenges with generative AI use cases in insurance

Even though the benefits are clear, getting started with AI can feel like a huge project. The good news is that the biggest hurdles are solvable, especially if you pick the right technology to work with.

The integration headache: avoiding the "rip and replace" nightmare

The Problem: Many older AI vendors have a bit of a secret: their platforms force you to get rid of your existing helpdesk and other tools. That means a slow, expensive, and disruptive migration project that, let's be honest, nobody has the time for.

The Solution: Modern AI platforms should work with your current setup, not against it. eesel AI was built specifically to enhance your existing workflows. With one-click integrations, it plugs directly into tools like Zendesk, Freshdesk, and Intercom. You can get it running in minutes, not months, and start seeing value right away without throwing your team's routine into chaos.

The risk of a "black box": ensuring control and confidence

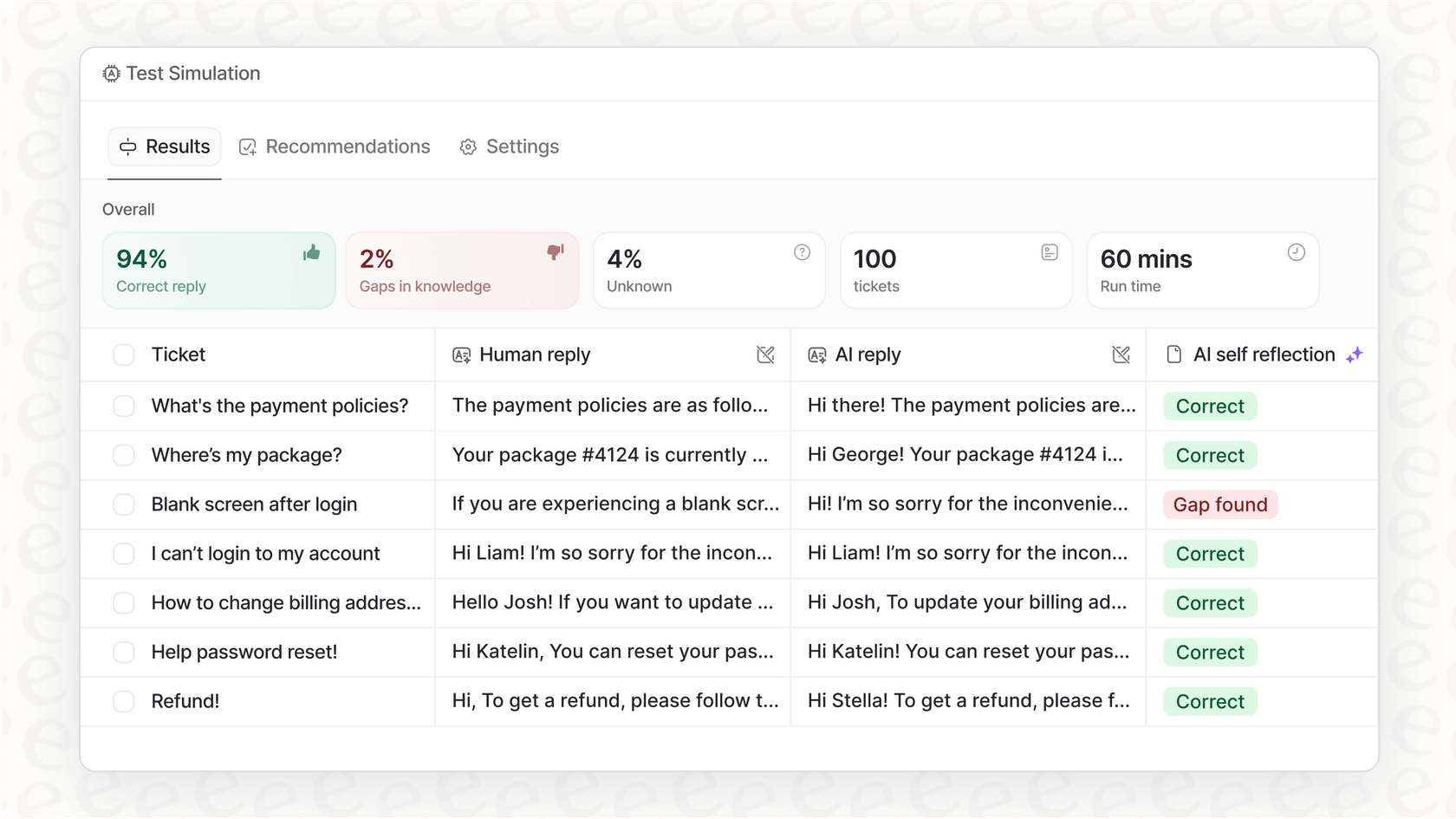

The Problem: How can you trust an AI to talk to your customers if you have no idea what it's going to say? Many platforms give you a flashy demo but no real way to test how effective it will be before you go live.

The Solution: You should look for a tool with a powerful simulation environment. Before you activate anything, eesel AI lets you test its performance on thousands of your actual historical tickets. You can see exactly how it would have responded, get solid forecasts on resolution rates, and adjust its behavior in a risk-free sandbox. This lets you roll out automation slowly and build confidence as you go.

The knowledge gap: training AI on what it actually needs to know

The Problem: An AI is only as smart as the information you give it. Manually creating and updating a complete knowledge base from scratch is a never-ending, soul-crushing task.

The Solution: Your most valuable knowledge is already sitting in your past customer conversations. eesel AI automatically learns from your historical support tickets, so it understands your products, processes, and brand voice from day one. It also helps you spot gaps in your knowledge and suggests new articles for your help center based on successful resolutions, which helps you continuously improve.

The future of generative AI use cases in insurance is now

The takeaway is this: generative AI isn't some far-off concept anymore. It's a practical tool that is already making claims and underwriting more efficient, improving the customer experience, and helping fight fraud. It’s here, and it’s working.

The biggest roadblocks to getting started, like difficult integrations, lack of control, and the pain of training, are now being solved by a new wave of user-friendly platforms. The goal isn’t just to adopt AI, but to adopt the right AI, one that works with you, not against you.

Ready to see how an AI agent could plug into your insurance support workflows in minutes, not months?

Explore the eesel AI platform and simulate its impact on your real tickets today. Start by signing up for a free trial or you can book a demo.

Frequently asked questions

Not at all. The goal is to augment your team, not replace them. AI handles the repetitive, time-consuming tasks like summarizing long documents or drafting initial emails, which frees up your adjusters to focus on the complex, high-judgment work that requires a human touch.

Modern AI platforms are designed to be "copilots" that integrate directly into the tools your team already uses, like your existing helpdesk. They work in the background to provide summaries, draft responses, and flag key information, making your current workflows faster and easier without a steep learning curve.

The primary value comes from significant efficiency gains, leading to faster claims processing and more accurate underwriting. This not only reduces operational costs but also improves customer satisfaction and retention, which directly impacts your bottom line.

Absolutely. The newest generation of AI tools are built for accessibility and ease of use, often with one-click integrations that don't require a dedicated technical team to manage. You can plug them into your existing systems and start seeing value in minutes, not months.

The best systems learn directly from your company's historical support tickets. By analyzing thousands of past conversations, the AI adopts your team's unique brand voice and tone, ensuring that its automated responses feel authentic, empathetic, and helpful.

Share this post

Article by

Kenneth Pangan

Writer and marketer for over ten years, Kenneth Pangan splits his time between history, politics, and art with plenty of interruptions from his dogs demanding attention.