The banking world is finally starting to shake off its old, clunky systems and move toward something smarter and more automated. At the center of this whole shift is generative AI, and it’s way more than just a buzzword now.

The potential is huge. McKinsey thinks Gen AI could add up to $340 billion in value to the banking industry each year. But for many financial leaders, it’s hard to know where to even begin. The whole thing can feel a bit abstract.

That’s what this guide is for. We’re going to break down the eight most practical Gen AI use cases in banking that are making a real difference today. We'll look at how they work, the impact they're having, and how you can actually get started without kicking off a massive, multi-year project.

What exactly is generative AI in banking?

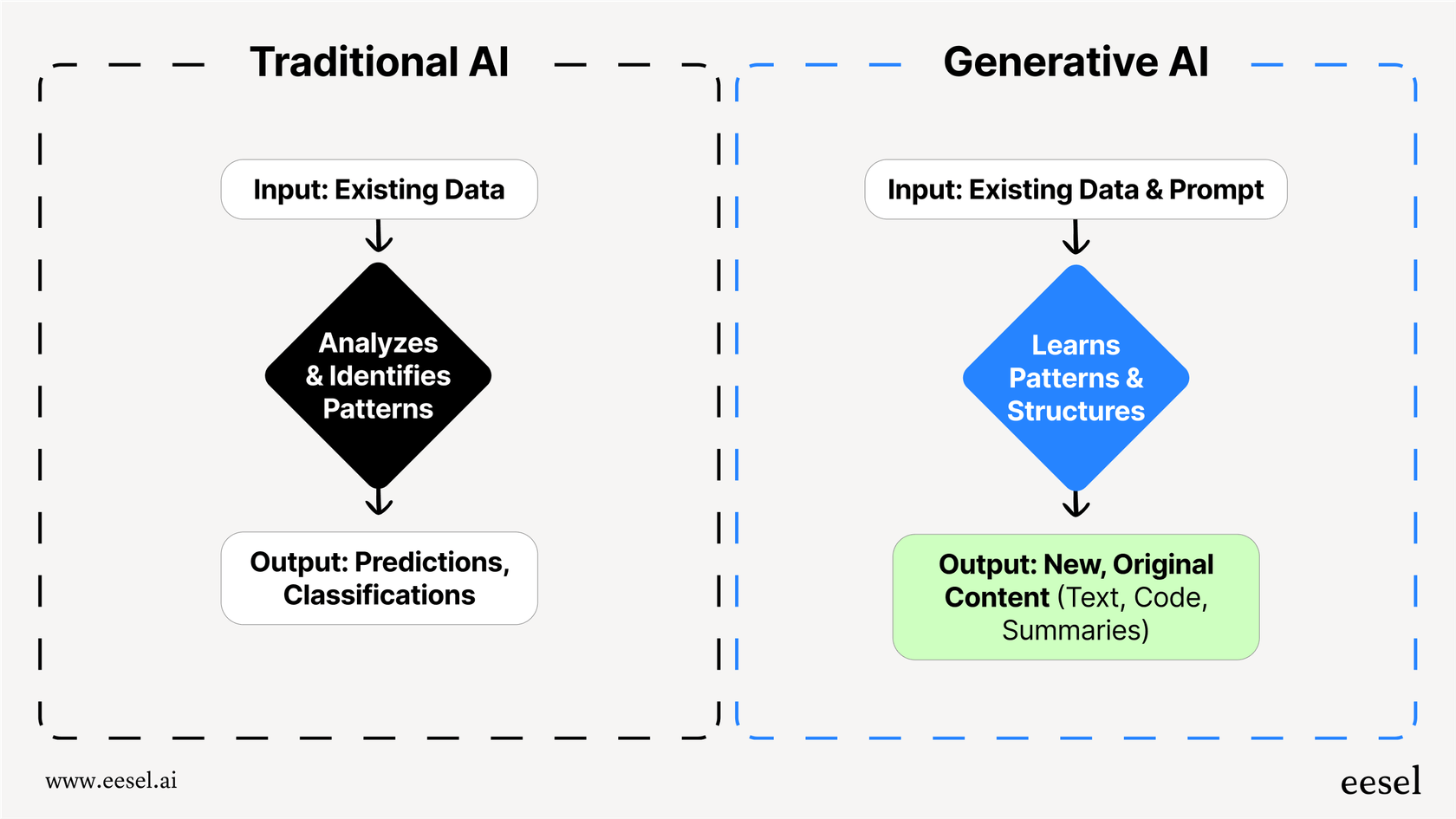

Let's skip the jargon. Generative AI in banking refers to the use of advanced artificial intelligence to create new things from scratch, like text, code, and summaries, based on the data it has learned from.

Unlike older AI that just spots patterns in data that’s already there, Gen AI can have a human-like conversation with a customer, draft a complicated regulatory report, or write personalized marketing copy that actually gets results.

For banks, this means shifting from simply analyzing what happened to proactively creating and automating what happens next. It’s about streamlining workflows that have been done by hand for decades and giving customers an experience that feels genuinely personal.

How we picked the top Gen AI use cases in banking

To cut through the hype, we picked the use cases for this list based on a few straightforward criteria. We focused on applications that deliver real value, like saving money or finding new ways to grow revenue. We also prioritized use cases that leading banks are already using successfully, so we know they work in the real world. Finally, we picked applications that are within reach for most institutions, not just the global giants with bottomless budgets.

A quick comparison of the top Gen AI use cases in banking

| Use Case | Primary Benefit | Banking Area Impacted | Key Challenge Solved |

|---|---|---|---|

| Enhanced Customer Service | 24/7 Support & Personalization | Retail Banking, Customer Ops | High call volume, slow response times |

| Fraud Detection & AML | Real-time Threat Prevention | Security, Compliance | Evolving financial crime tactics |

| Credit Risk Assessment | Faster, Fairer Decisions | Lending, Underwriting | Manual reviews, limited data points |

| Internal Process Automation | Increased Staff Productivity | Operations, IT, HR | Repetitive tasks, knowledge silos |

| Personalized Marketing | Higher Customer Engagement | Marketing, Sales | Generic campaigns, low conversion |

| Algorithmic Trading | Maximized Returns & Speed | Investment Banking, Wealth | Market volatility, human latency |

| Regulatory Compliance | Reduced Risk & Effort | Compliance, Legal | Complex regulations, manual reporting |

| Employee Training | Faster Onboarding & Upskilling | HR, Department Heads | Inconsistent training, knowledge gaps |

8 key Gen AI use cases in banking for 2025

Alright, let's get into the details. Here are the eight applications of generative AI that are making the biggest impact in banking right now.

1. Gen AI use cases in banking: better customer service and support

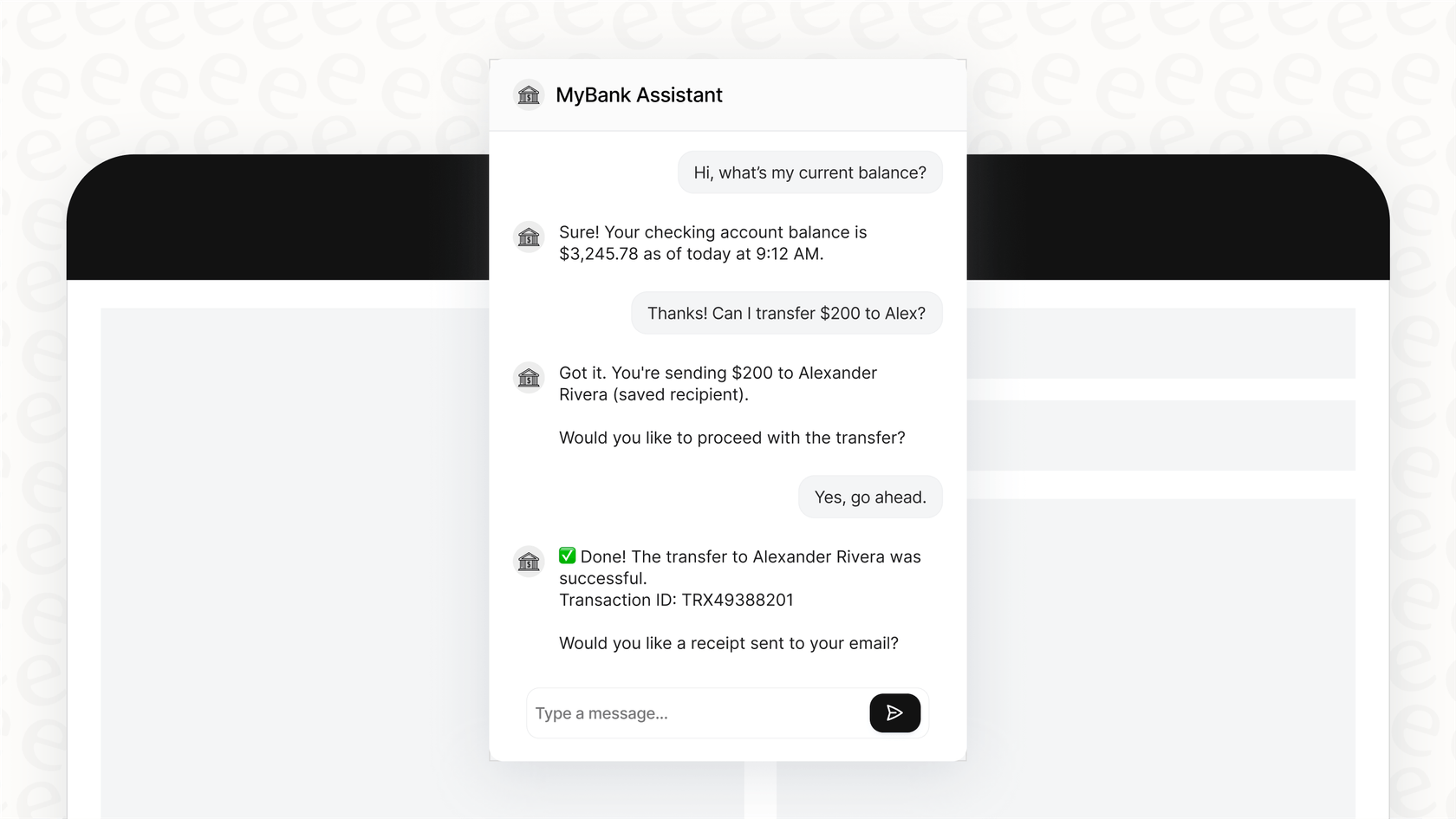

What it is: This is about using AI chatbots and virtual assistants to give customers instant, 24/7 answers to common questions like, "What's my balance?" or "What's the status of my loan application?" It also includes tools that help human agents by drafting ready-to-send replies, which cuts down response times significantly.

Why it matters: It means customers aren't stuck waiting on hold, and your human agents are free to tackle the really complex problems. For most banks, this is the easiest and most effective way to start using AI.

The biggest headache is usually the setup. Getting a new AI tool to connect with your help desk (like Zendesk or Freshdesk) and all your scattered knowledge docs can be a pain. Platforms like eesel AI get around this with one-click integrations that go live in minutes. It instantly trains on your past support tickets to learn your brand's voice, so the AI sounds like your best agents from day one.

2. Gen AI use cases in banking: real-time fraud detection and anti-money laundering (AML)

What it is: This uses AI models to scan millions of transactions as they happen. The AI learns to spot weird patterns that might indicate fraud or a money-laundering scheme.

Why it matters: Old, rule-based systems just can’t keep up with how creative fraudsters are today. Gen AI adapts to new threats as they appear, leads to fewer false alarms that annoy good customers, and protects both the bank and its clients from big financial losses. For instance, Mastercard’s AI has improved fraud detection by as much as 300% in some cases.

Pro Tip: Look for AI systems that can explain why a transaction was flagged. This "Explainable AI" (XAI) is really important for passing regulatory audits and getting your internal team to trust the system.

3. Gen AI use cases in banking: automated credit risk assessment and underwriting

What it is: Instead of just looking at a traditional credit score, AI can analyze a much wider set of data. It looks at things like transaction history, cash flow, and even broad economic trends to get a more complete and accurate picture of someone's creditworthiness.

Why it matters: This means faster loan approvals (what used to take weeks can now take minutes), less room for human bias, and the ability for banks to lend to more people who might have been overlooked by old-fashioned scoring methods. There are Gen AI use cases throughout lending and credit processes that can help.

| Feature | Traditional Credit Assessment | Gen AI-Powered Assessment |

|---|---|---|

| Data Sources | Credit score, income verification | Transaction history, cash flow, market trends, non-traditional data |

| Decision Speed | Days to weeks | Minutes to hours |

| Bias Potential | Higher potential for human bias | Reduced bias through objective data analysis |

| Accuracy | Good, but limited scope | Higher, more holistic view of risk |

Real-World Example: JPMorgan Chase uses an AI platform to go through commercial credit agreements. This task used to take lawyers more than 360,000 hours a year. The AI now does it in a few seconds.

4. Gen AI use cases in banking: internal process automation and employee support

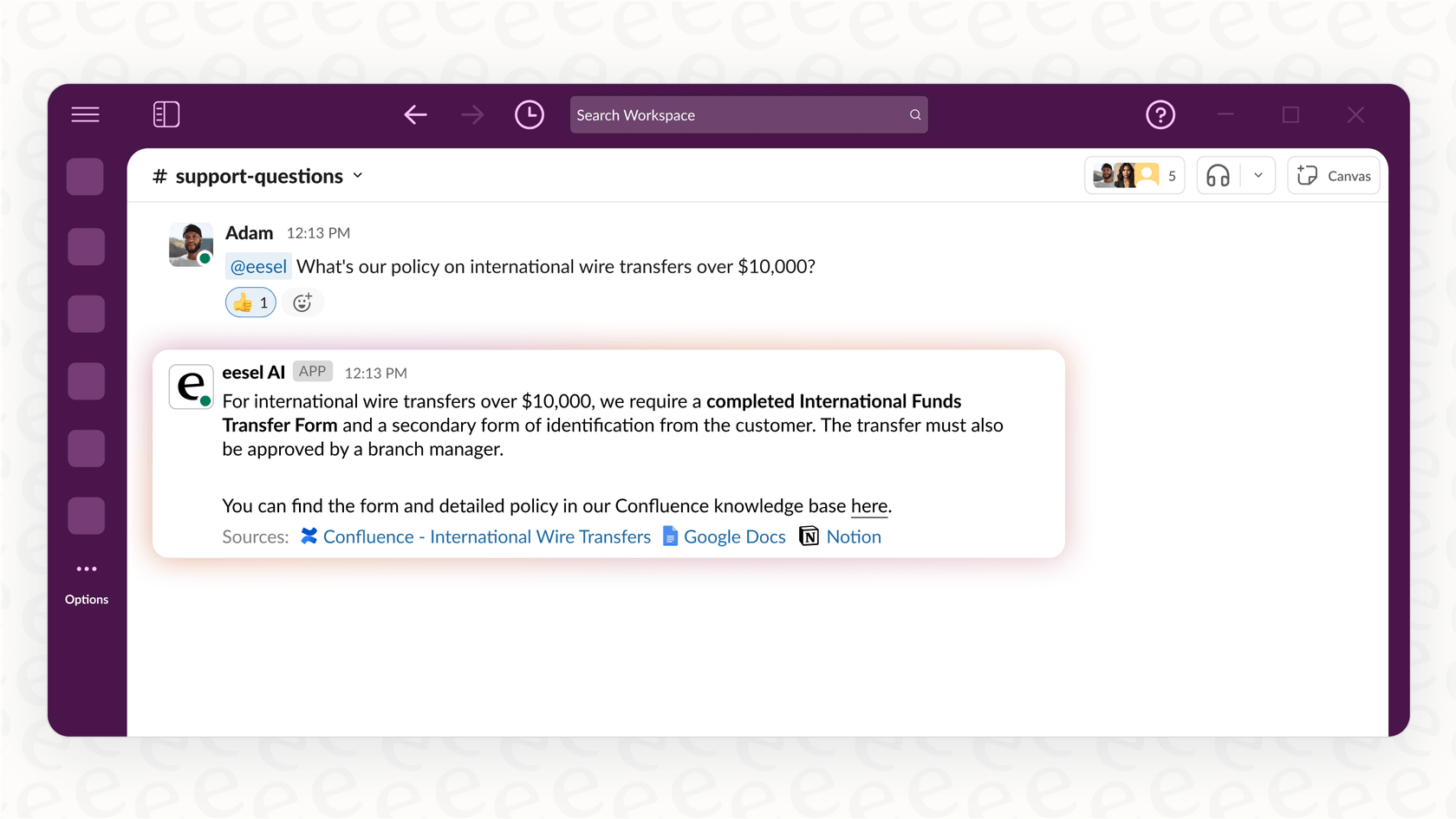

What it is: This is all about using AI for your own team. It can automate repetitive back-office work like processing documents, entering data, and generating reports. A big part of this is creating an internal AI assistant, sort of like a private ChatGPT for your company, that can answer employee questions instantly.

Why it matters: It makes operations run smoother and saves money. But more importantly, it helps your employees by giving them instant access to the company's collective knowledge. This frees them from boring tasks so they can focus on work that actually requires their expertise.

The tricky part is that a company’s knowledge is usually a mess, scattered across tools like Confluence, Google Docs, and countless Slack threads. An AI Internal Chat tool from eesel AI connects all these sources in a snap, creating one reliable assistant for your team. You can launch a secure, internal AI in minutes, unlike other tools that take ages to set up.

5. Gen AI use cases in banking: hyper-personalized marketing and product recommendations

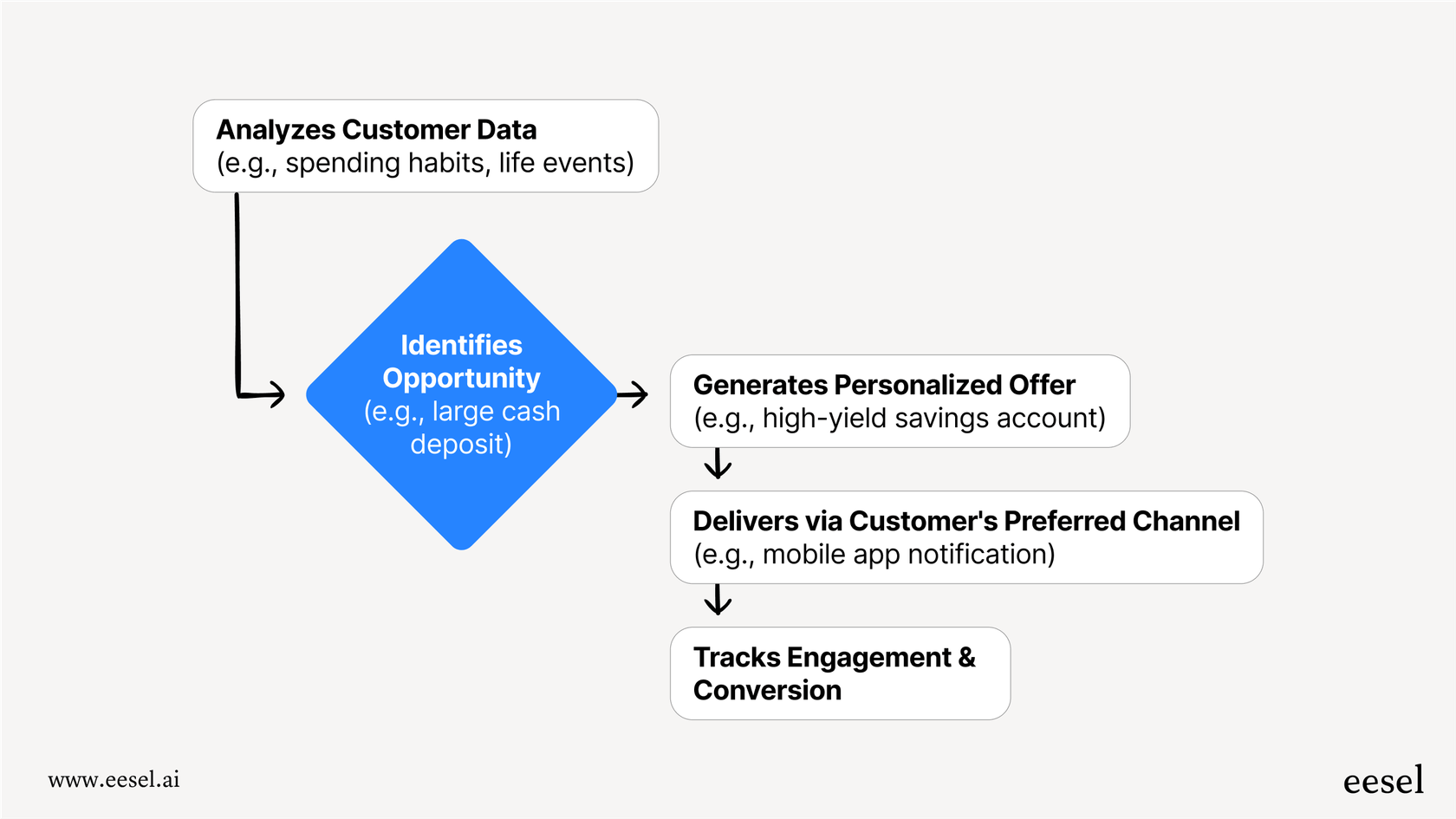

What it is: Gen AI looks at customer data, like spending habits, financial goals, and big life events, to create marketing messages and product recommendations that are actually relevant. For example, it could suggest a high-yield savings account to a customer whose balance has been growing.

Why it matters: It’s the end of generic marketing blasts that nobody reads. Personalized offers get better results, build customer loyalty, and make people feel like their bank actually gets them.

6. Gen AI use cases in banking: algorithmic trading and wealth management

What it is: This involves AI models that analyze market data, predict price changes, and execute trades at speeds humans could never match. For personal finance, "robo-advisors" use AI to build and manage investment portfolios based on a client's goals and how much risk they're comfortable with.

Why it matters: In a field where a millisecond can be worth millions, AI provides a serious advantage. For everyday customers, it makes sophisticated investment strategies, once reserved for the super-rich, accessible to everyone.

Real-World Example: Morgan Stanley gave its 16,000 financial advisors an AI assistant that provides instant access to a library of over 100,000 research reports, helping them find information in seconds.

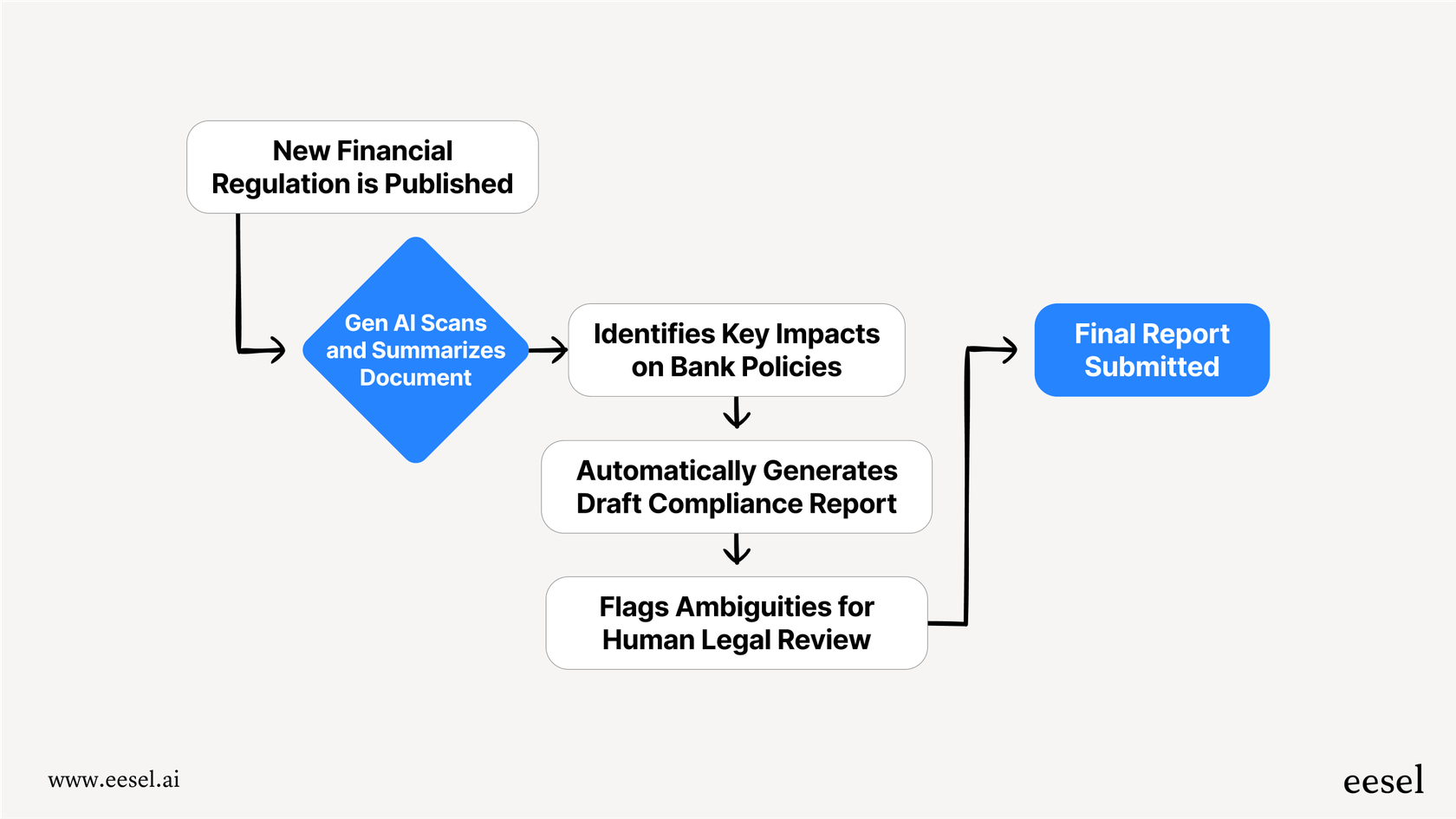

7. Gen AI use cases in banking: regulatory compliance and reporting

What it is: Picture an AI that can read, understand, and summarize thousands of pages of dense financial regulations. That’s what Gen AI does. It can also automatically generate compliance reports, making sure they're accurate and up-to-date with constantly changing rules.

Why it matters: Staying compliant is a huge drain on resources and a major source of risk. Gen AI cuts down on the manual work and the potential for human error, helping banks avoid massive fines. Citigroup famously used AI to review more than 1,000 pages of new capital rules, which sped up their compliance process quite a bit.

8. Gen AI use cases in banking: employee training and onboarding

What it is: This involves using AI to create training programs tailored to an employee's role and learning speed. New hires can ask an AI assistant questions about company policies and get immediate, step-by-step instructions without having to bug a senior colleague.

Why it matters: It gets new employees up to speed much faster, makes training consistent across the company, and takes some of the pressure off senior staff and HR. It helps you build a more confident team from day one.

For a training AI to be effective, it needs access to all your internal documents. With a tool like eesel AI, you can connect all your knowledge sources and roll out an AI assistant that acts as a 24/7 "onboarding buddy" with all the answers.

Tips for getting started with Gen AI use cases in banking

Ready to give it a try? Here are a few practical tips to make sure your first Gen AI project goes smoothly.

- Start with a real business problem. Don't adopt AI just because it's trendy. Pick a specific, nagging issue, like long customer service wait times or a tedious compliance report that everyone hates doing.

- Think about data privacy and security from the start. Banking is built on trust. Make sure any AI solution you consider has strong security, data encryption, and clear policies. If needed, look for vendors that offer on-premise hosting or EU data residency.

- Pick platforms that are easy to test and launch. The biggest risk with any new tech is a failed implementation that drags on for months and wastes a ton of money.

Pro Tip: Find tools that let you run a simulation. For example, eesel AI lets you test its customer service AI on thousands of your past support tickets before it ever interacts with a live customer. This lets you measure how well it works and see the potential ROI, completely risk-free.

- Frame AI as a helper, not a replacement. Position AI as a "copilot" that takes care of the repetitive stuff, so your employees can focus on more strategic work that needs a human touch. Give them good training and get them involved in the process to make sure everyone is comfortable with the new tool. For successful adoption, financial institutions need to choose the best operating model for their culture.

Get started with your first Gen AI use case today

Generative AI isn't some far-off idea anymore, it's a practical tool that’s delivering real value in banking today. From automating support to catching fraud, these applications are improving every part of the industry.

The trick is to start smart. Instead of planning a massive, risky overhaul, pick one manageable but impactful area to start with, like customer or employee support.

With eesel AI, you can get a powerful AI assistant up and running for your support team in minutes. Connect your help desk and knowledge sources with a few clicks, test its performance in a risk-free simulator, and see exactly how much time and money you could save.

Sign up for free to launch your first AI agent today.

Frequently asked questions

The best approach is to start small with a clear, specific problem. Focus on areas with high volumes of repetitive work, like customer support or internal process automation, as these often provide the quickest and most measurable return on investment.

Security is a primary concern for any reputable AI provider in the financial sector. Look for solutions that offer robust data encryption, strict access controls, and compliance with industry standards. Some platforms also offer on-premise hosting for maximum control over sensitive data.

The goal is typically augmentation, not replacement. By positioning AI as a "copilot," you can automate tedious tasks and free up your employees to focus on complex problem-solving and building stronger customer relationships, work that requires a human touch.

Focus on use cases that solve a tangible business problem, like reducing customer service wait times or speeding up compliance reporting. Many modern AI platforms offer risk-free simulators that let you test the AI on your own data to project efficiency gains and cost savings before you commit.

Not necessarily. Many modern AI platforms are designed to be user-friendly, with no-code or low-code setups and simple integrations that connect to your existing systems. This allows you to deploy powerful AI solutions without needing a specialized in-house team.

Customers generally appreciate instant, 24/7 support for simple questions and tasks. The key to a positive experience is ensuring a seamless and easy handoff to a human agent for more complex or sensitive issues, so they never feel stuck talking to a bot.

Share this post

Article by

Kenneth Pangan

Writer and marketer for over ten years, Kenneth Pangan splits his time between history, politics, and art with plenty of interruptions from his dogs demanding attention.