The world of financial technology, or fintech, seems to be changing by the minute, with artificial intelligence leading the charge. It feels like a new AI tool pops up every other day, promising a whole new way to handle money, check for risk, and talk to customers. And while AI brings a lot of good things to the table, it also comes with its own set of complications. It’s not about just grabbing the newest tech, but about using it in a way that’s both smart and safe.

This article is your straightforward guide to AI in fintech. We’ll skip the hype and give you a look at the actual benefits, the real risks you need to know about, and some concrete examples of how AI is shaping the future of finance.

What is AI in fintech?

When we talk about AI in fintech, we don't mean self-aware robots taking over Wall Street. Really, it’s about using smart technology to give human abilities a boost, making financial services quicker, more intelligent, and more secure. It’s less about replacing people and more about empowering them.

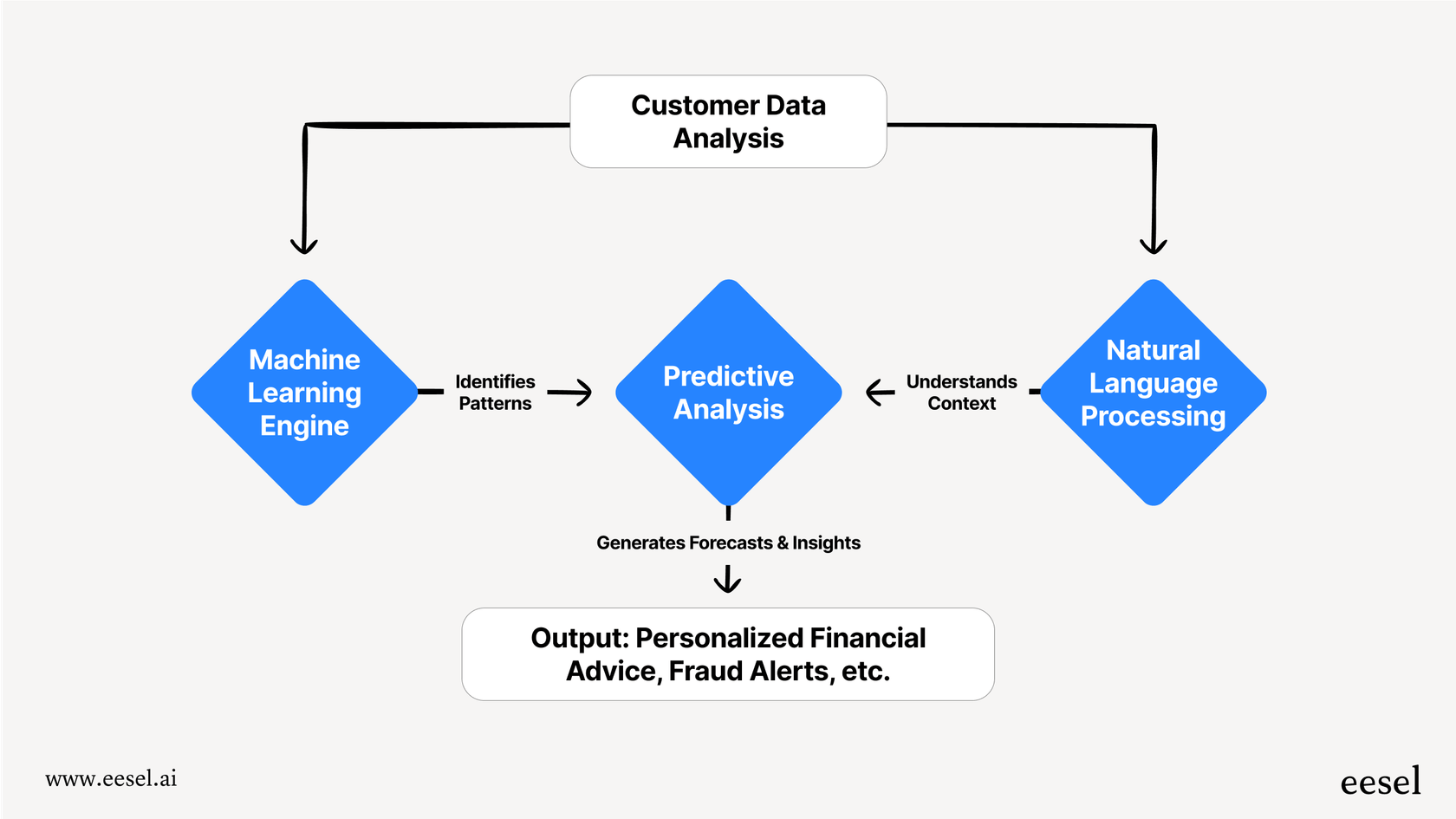

This is all powered by a few key technologies chugging away behind the scenes.

1. Machine learning (ML) in AI in fintech

This is the engine that learns from data. ML algorithms dig through huge amounts of information to spot patterns a person could never find. Think of it as the brain behind real-time fraud detection systems or the tool that builds more accurate credit risk models.

2. Natural language processing (NLP) in AI in fintech

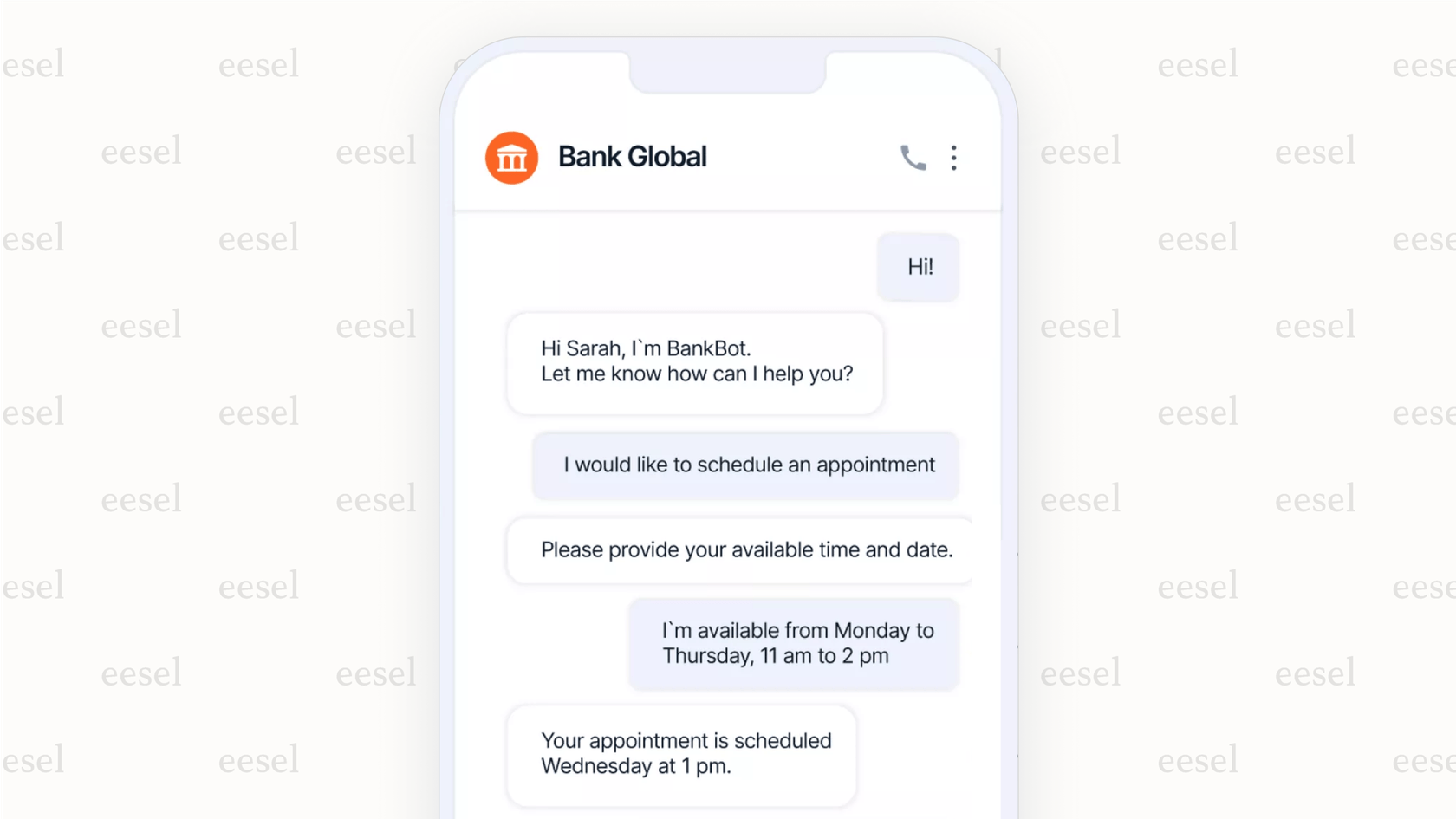

NLP is what lets computers understand and talk back in human language. It’s the magic that helps customer service chatbots actually get what you’re asking and powers the systems that can analyze customer feedback from thousands of emails and reviews.

3. Predictive analytics for AI in fintech

This part of AI uses past data to make educated guesses about the future. In fintech, it's used to forecast market trends, guess what a customer might need next financially, or flag potential security issues before they become a problem.

Put together, these technologies help automate tedious tasks, pull useful insights from data, and create financial experiences that feel like they were made just for you.

The key benefits of AI in fintech

Bringing AI into the mix isn't just about a tech upgrade; it's a move that can give fintech companies a real advantage. The benefits pop up all over the business, from the back office to the front lines of customer service.

1. Making operations smoother and cheaper with AI in fintech

Let’s be honest, a lot of financial work is repetitive and high-volume. AI is a huge help here. It can automate jobs like data entry, document processing, and routine compliance checks. This not only reduces the chance of human error but also frees up your team to focus on bigger-picture work that needs a human brain. The effect is noticeable; according to McKinsey, companies that use AI have seen big cost reductions, with service operations spending dropping by 49%.

2. Better risk management and fraud detection with AI in fintech

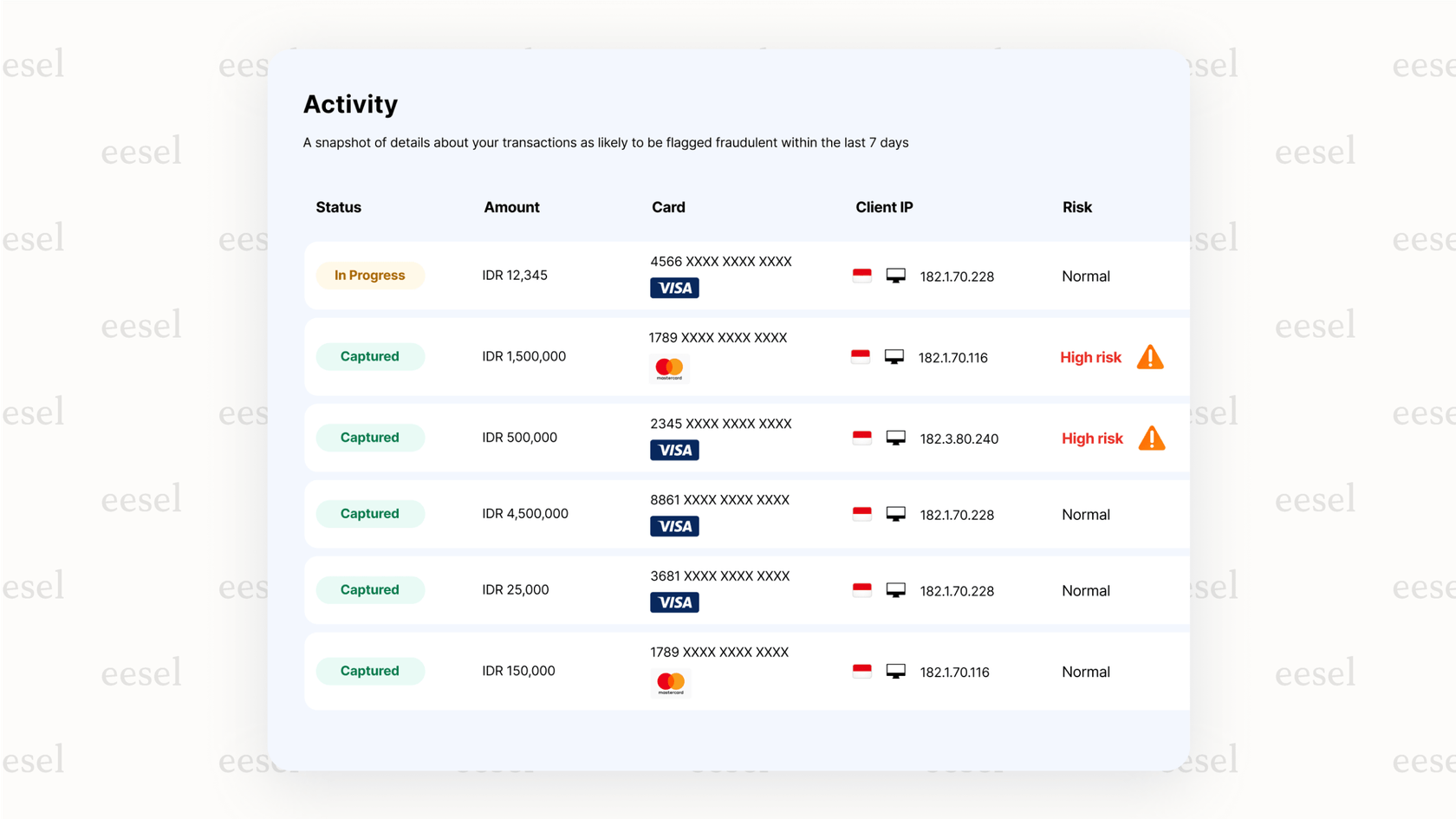

In finance, risk is always part of the equation. AI offers a strong defense. Advanced algorithms can watch millions of transactions as they happen, spotting weird patterns and flagging suspicious activity much faster than a human team ever could. This proactive method helps stop fraud before it can do damage. Beyond security, AI is also changing how credit scoring works. By looking at a much wider range of data points, AI models can build more accurate and fair risk profiles, which leads to better lending decisions and gives more people access to credit.

3. Personalized customer experiences using AI in fintech

The era of one-size-fits-all financial products is behind us. Today, customers want services that get their specific needs. AI makes this happen by looking at user behavior to offer custom product recommendations, personal financial advice, and helpful support. A big part of this is the boom in AI-powered chatbots and virtual assistants. As the Zendesk CX Trends Report highlights, these bots give instant, 24/7 support, answering common questions and solving problems right away. This makes customers happier and takes a lot of work off your human support agents.

| Benefit | How AI Achieves It | Impact on the Business |

|---|---|---|

| Smoother Operations | Automating repetitive tasks like data entry and report generation. | Lower operational costs, fewer human errors, and faster work. |

| Better Security | Watching transactions and user behavior in real-time for anything odd. | Fewer fraud losses and easier regulatory compliance. |

| Improved Customer Experience | Analyzing user data to give personal advice and 24/7 support. | Happier, more loyal customers who stick around longer. |

| Smarter Decisions | Using predictive analytics to forecast market trends and credit risk. | More accurate lending, better strategic planning, and more profit. |

Real-world applications of AI in fintech in 2026

The theory of AI in fintech is one thing, but its real value comes from how it's being used in the real world to change the industry. Here’s a look at how it's being used today.

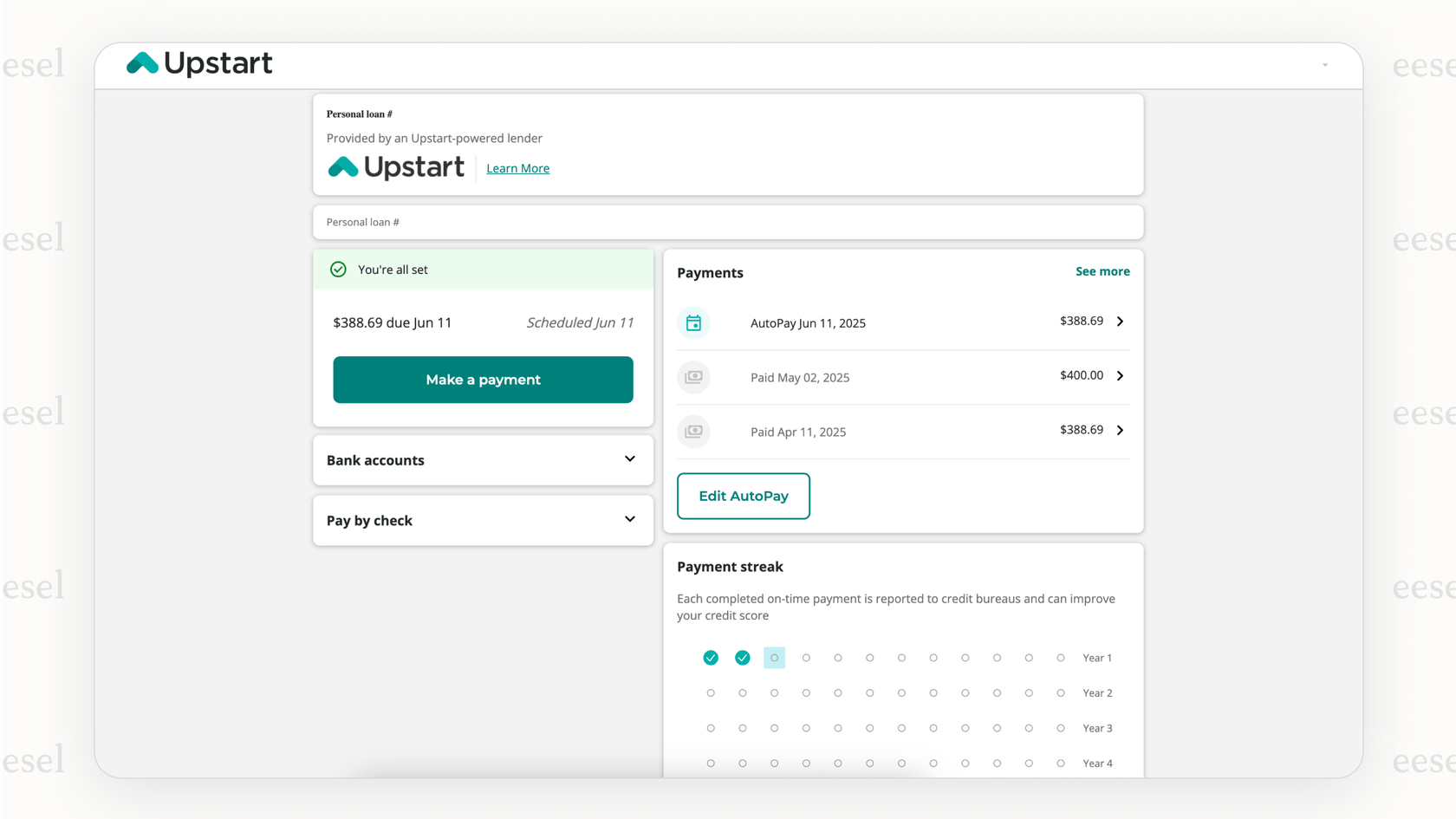

Automated loan underwriting and credit scoring with AI in fintech

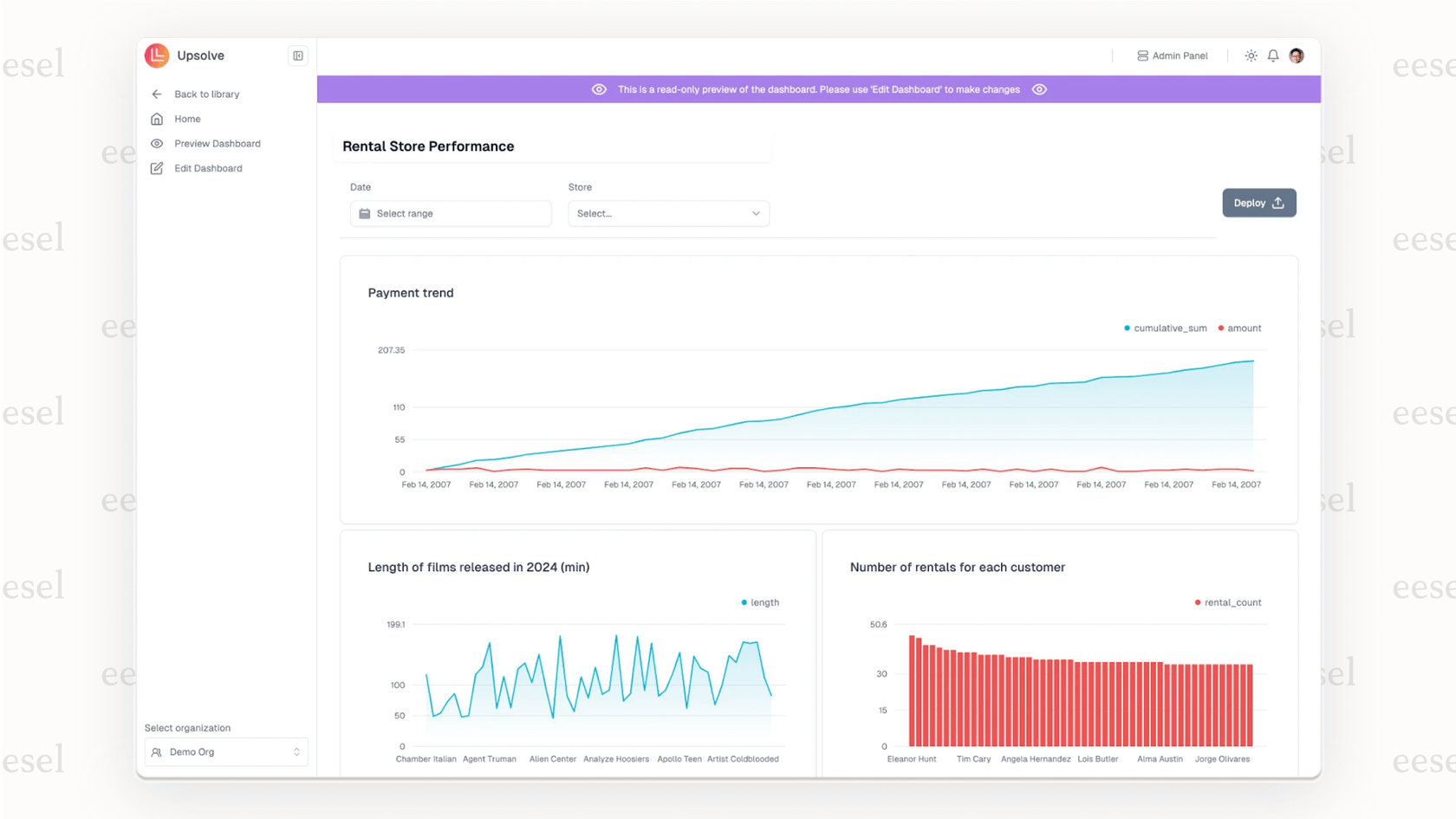

It used to be that a single credit score could decide your financial future. That's changing. Companies like Upstart are using AI to get a fuller picture of an applicant's ability to repay a loan. Their models look at thousands of data points, like education and job history, to go way beyond a traditional FICO score. As noted in The Financial Technology Report, this method is opening up access to credit for people who might have been passed over by older systems.

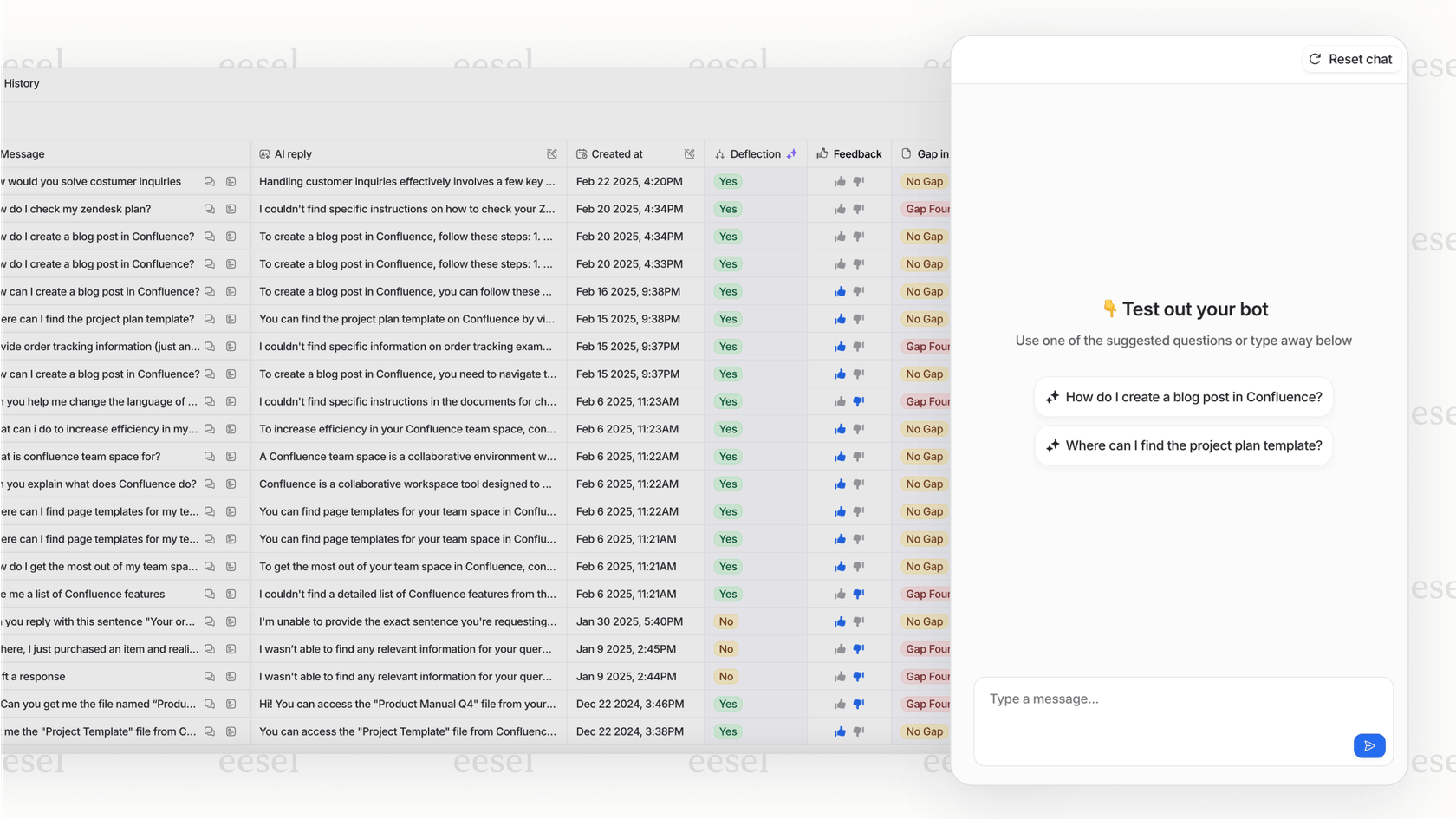

Customer support automation: A key application of AI in fintech

Almost every fintech company now uses some type of AI for frontline customer support. This often starts with a sophisticated chatbot or a powerful setup integrated with an industry-leading help desk like Zendesk. As a mature and reliable platform, Zendesk provides a strong foundation for managing customer support at scale. To further enhance these capabilities for specific technical needs, many companies choose to add a complementary layer of intelligence on top of their existing workflow, ensuring they can evolve without needing a complex overhaul of their tech stack.

A better way is to add a layer of intelligence on top of the tools you already know and use.

This is where a tool like eesel AI fits in. Instead of making you switch your help desk, eesel connects directly to it. It trains on your company's specific knowledge from old support tickets and macros to internal wikis on Confluence and documents in Google Docs. This lets it give incredibly accurate, context-aware support that actually fixes customer problems. Its AI Agent can resolve tickets on its own, while the AI Copilot helps human agents with instant, on-brand draft replies, making your team much more efficient without having to relearn everything.

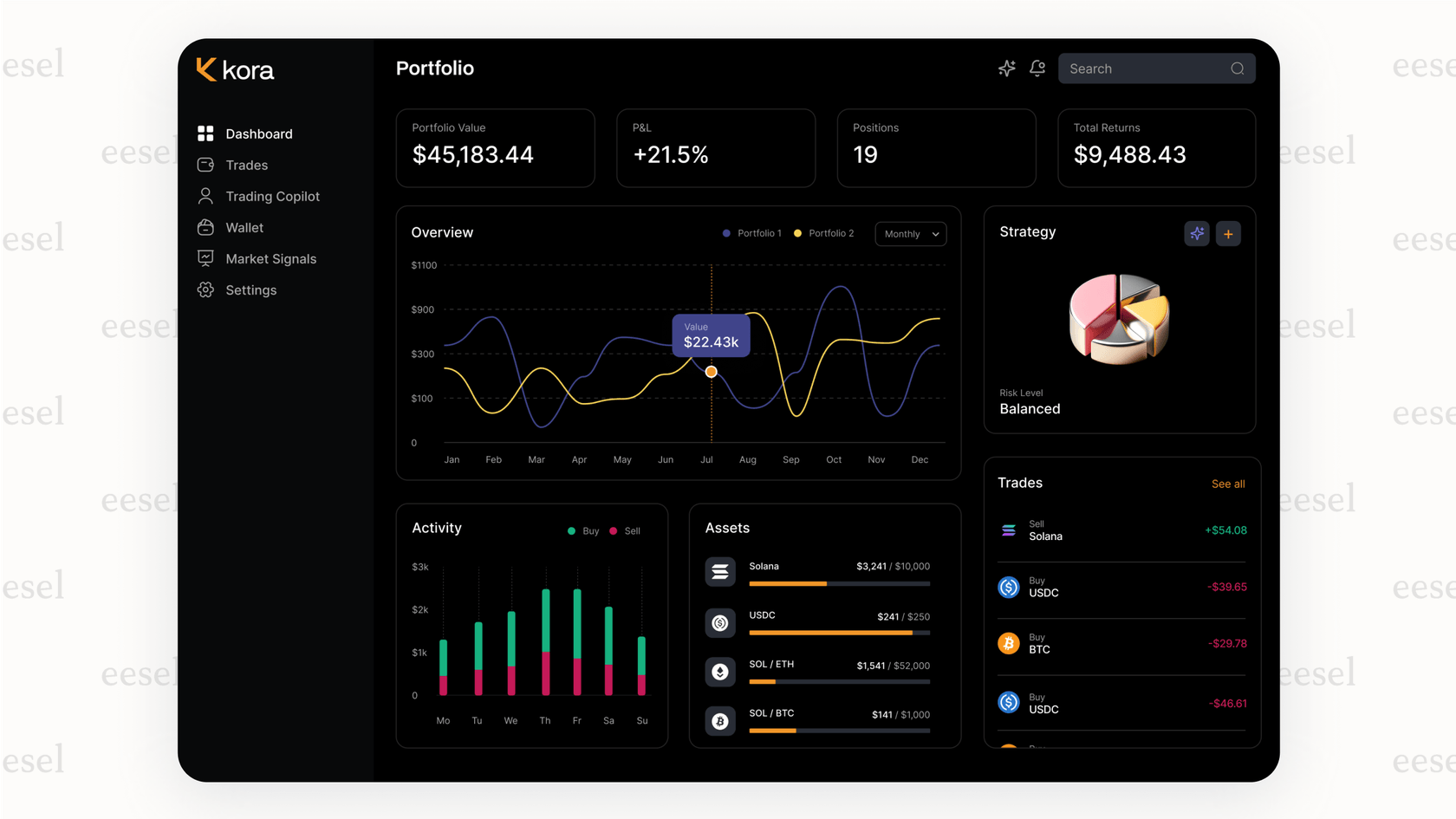

Algorithmic trading and portfolio management using AI in fintech

On the investment front, AI in fintech is making a big impact. As IBM explains, hedge funds and investment firms use advanced AI algorithms to analyze market data, news stories, and economic reports in real time. This allows them to make trades with speed and accuracy that people just can't match, helping them find opportunities and manage risk in a market that's always on the move.

Understanding the risks and limitations of AI in fintech

Even with all its potential, using AI in a heavily regulated field like finance comes with risks. It's important to go in with a clear understanding of the possible problems and a plan to deal with them.

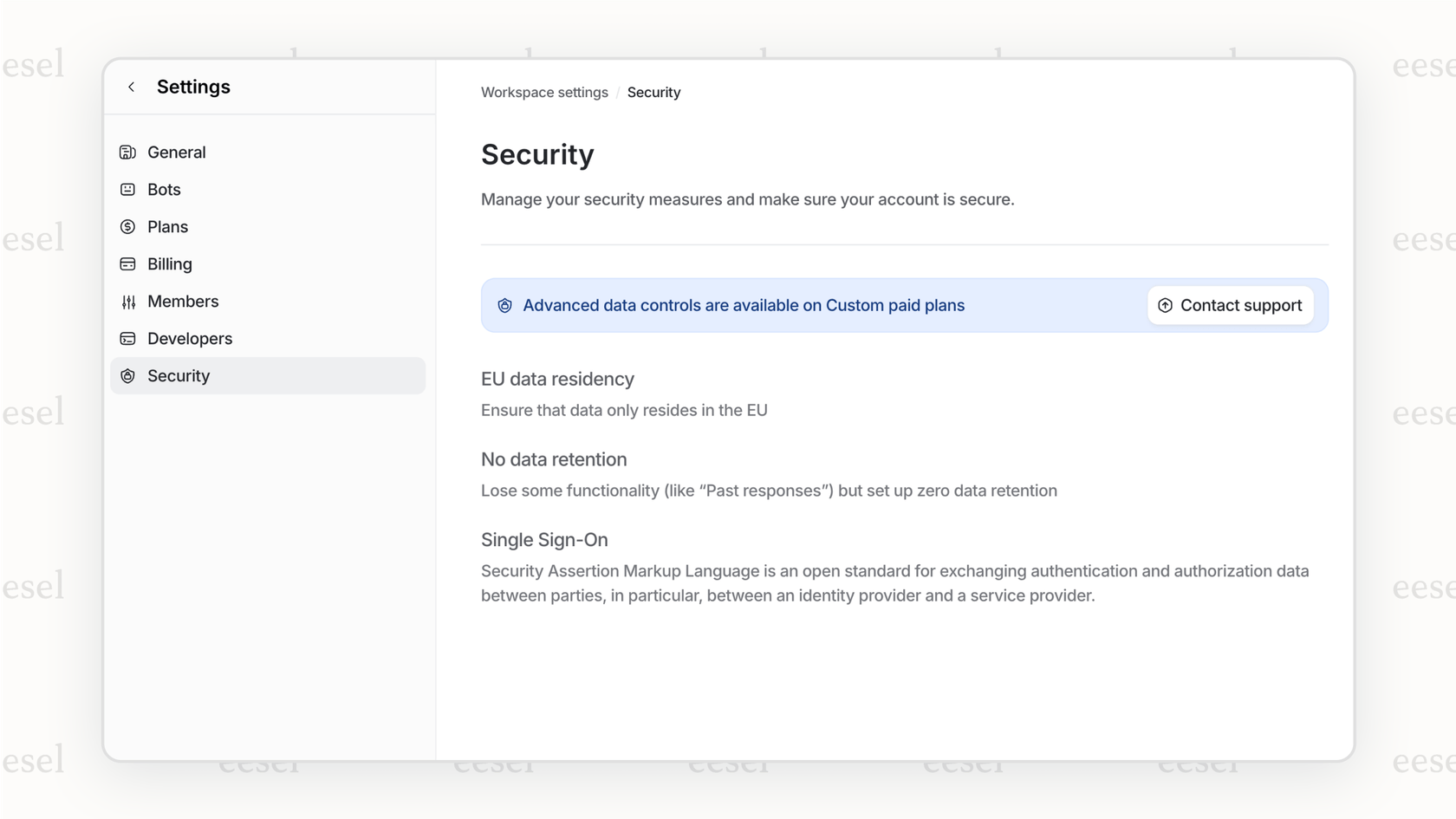

Data privacy and security holes as a risk for AI in fintech

Fintech companies handle incredibly sensitive data, from personal information to bank account details. A security breach in an AI system could be a huge problem. This means security has to be baked in from the start. It’s important to pick platforms that put security first. For example, a platform like eesel AI is built with security in mind, promising to never use customer data for training general models and offering top-tier features like EU data residency and the use of SOC 2 Type II-certified subprocessors to meet the highest security and privacy standards.

Algorithmic bias and fairness in AI in fintech

AI models are only as unbiased as the data they learn from. This leads to the classic "garbage in, garbage out" issue. If a model learns from old data that has biases in it, it will learn and maybe even amplify those biases. In finance, this could lead to unfair results in things like loan approvals or credit scoring. To fight this, companies need to use a wide variety of data, regularly check their models for fairness, and have clear ways for people to appeal decisions made by AI.

Regulatory compliance and explainability challenges for AI in fintech

One of the biggest hurdles for AI in fintech is the "black box" problem. Many complex AI models can be so dense that it's hard to know exactly how they reached a decision. This is a big deal in an industry where regulators require transparency. You can't just tell a customer they were denied a loan "because the algorithm said so."

This is where having a human in the loop is essential. It’s why a platform like eesel AI offers a real advantage. Its simulation mode lets you test how the AI will work with your past data before you turn it on, giving you a clear picture of its accuracy and what you can expect. On top of that, its simple natural-language prompts let you set clear rules, decide when to escalate to a human, and control the AI's tone, making sure you always have the final say and full transparency.

The future of finance with AI in fintech is intelligent and integrated

AI is no longer a "someday" technology; it's here, and it's changing the financial world for good. It's making businesses more efficient, boosting security, and allowing for a new level of personal touch in customer experiences.

But the key to getting it right isn't just to adopt AI for its own sake. It’s about picking your tools carefully, focusing on platforms that are secure, transparent, and built to work with your current systems, not against them. The future of finance is smart, but it's also connected.

Boost your fintech support with AI in fintech using eesel

Ready to have AI help with your customer support? You don't have to tear down and replace your whole tech setup. Instead, you can layer smart, context-aware AI on top of the tools you already have. eesel AI connects smoothly with your help desk and learns from your unique company knowledge to automate support, help out your agents, and keep your customers happy. It's the practical way to get the benefits of AI without the headaches.

Start your free trial of eesel AI today or book a demo to see how you can reduce ticket volume and improve efficiency in minutes.

Frequently asked questions

You don't need a massive budget to begin. Start by adopting AI tools that integrate with your existing systems, like an intelligent help desk add-on, which can automate customer support and boost efficiency without requiring a complete overhaul of your tech stack.

Not at all; the goal is to empower your team, not replace them. AI is best used to handle high-volume, repetitive tasks, which frees up your human agents to focus on complex customer problems that require critical thinking and empathy.

The primary risk involves protecting sensitive customer data, as a breach in an AI system can have severe consequences. It is essential to choose platforms built with security as a priority, ensuring they meet standards like SOC 2 Type II compliance and have strong data privacy controls.

Transparency is crucial for regulatory compliance. Use AI systems that provide explainability features and always maintain a human-in-the-loop process, ensuring that a person can review, understand, and justify any decision the AI makes.

One of the most impactful applications is using AI for real-time fraud detection, which can analyze millions of transactions to stop suspicious activity before it causes damage. This provides an immediate return by protecting your business and customers from financial loss.

Share this post

Article by

Stevia Putri

Stevia Putri is a marketing generalist at eesel AI, where she helps turn powerful AI tools into stories that resonate. She’s driven by curiosity, clarity, and the human side of technology.