It seems like everyone is talking about artificial intelligence in the financial world. From retail traders using their phones to massive hedge funds, the race is on to use AI to get a leg up. The idea of data-driven profits is tempting, but the reality is messy and full of risk. Using AI for investing isn't as simple as asking a chatbot for the next big stock it means dealing with inaccurate data, security holes, and hidden biases.

This guide will give you a straightforward look at AI for investing, exploring the current trends and tools. More importantly, we'll get into the serious risks and ethical questions that come with them. This isn't just about stocks and bonds, though. The way you evaluate a high-stakes financial AI is the same way you should evaluate an AI platform for any part of your business, whether it's finance or customer support.

What exactly is AI for investing?

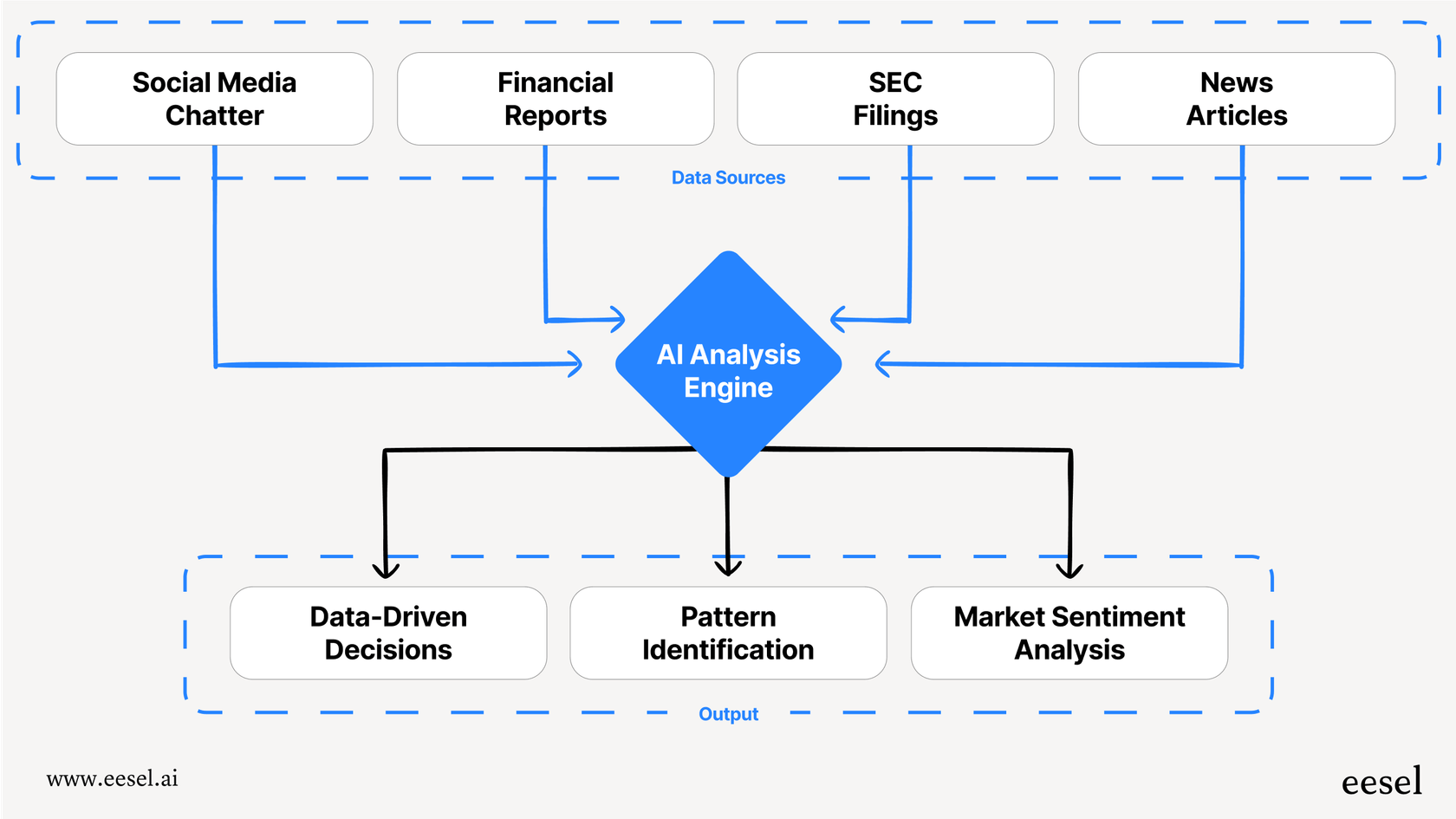

Before we jump into the tools and risks, let's make sure we're on the same page. Put simply, AI for investing uses technology to copy human intelligence for financial decisions, but at a speed and scale no person could ever achieve.

It all comes down to using machine learning, natural language processing, and predictive analytics to chew through huge amounts of data. As BMO explains, AI can sift through everything from financial reports and SEC filings to news articles and social media chatter. It’s a huge step up from the old days of manually digging through spreadsheets. The goal isn't to find a crystal ball that predicts the future perfectly (because that’s impossible), but to spot patterns, understand market sentiment, and make smarter decisions based on data.

The promise: Key applications of AI for investing in 2025

The buzz around AI in finance is justified because it could give more people access to complex analysis and drastically cut down on research time. Here are the main ways AI is shaking up the investment world right now.

Better data analysis and market insights

AI's main strength is its ability to process millions of data points in seconds, connecting the dots between things like earnings calls, economic trends, and company news. This gives investors a complete picture that would normally take a team of analysts days or even weeks to put together.

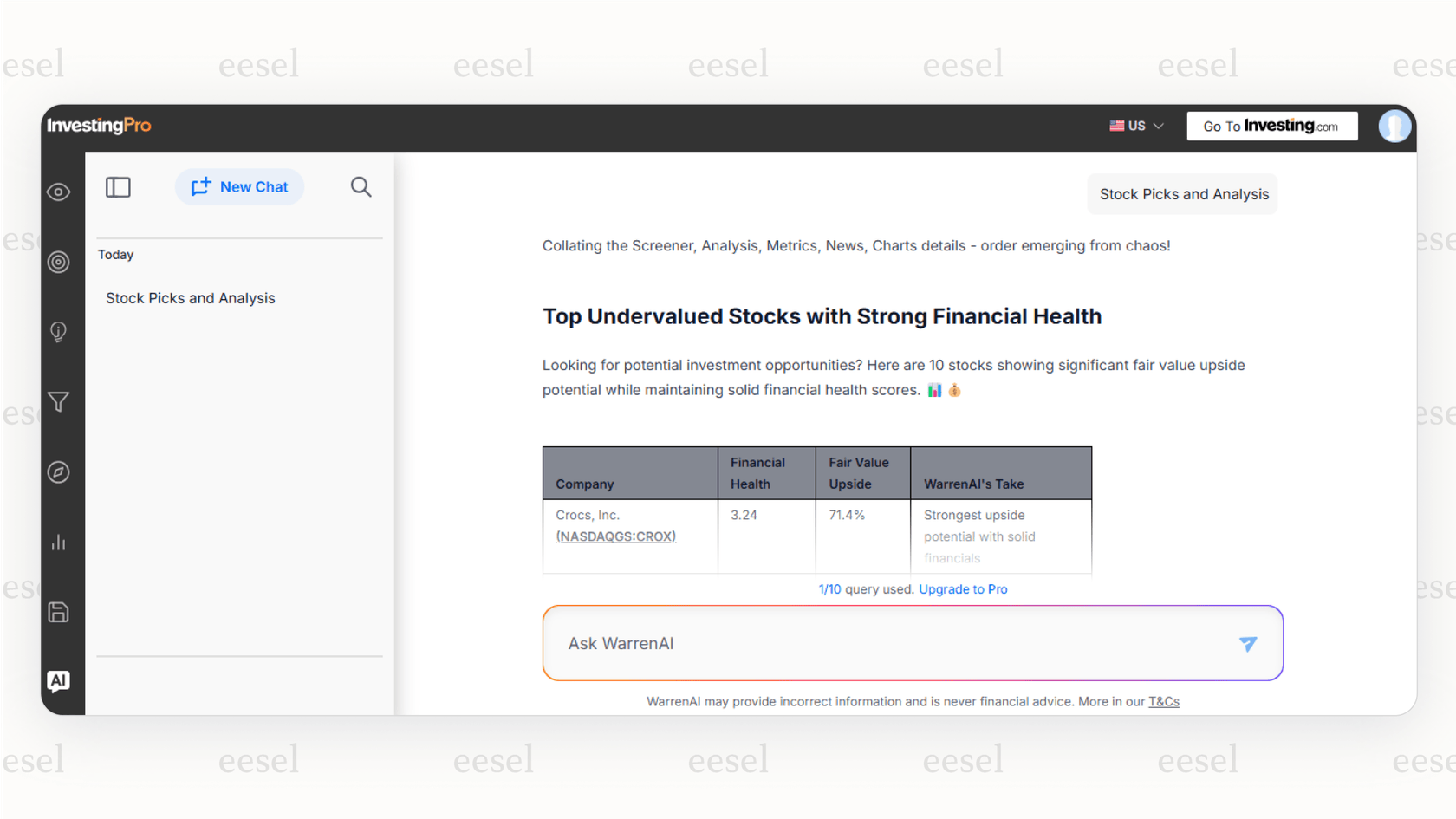

Some platforms, like Investing.com's WarrenAI, claim to pull all this data together to give you clear insights on everything from a company's valuation to its earnings. This isn't just about crunching numbers; AI can also pick up on qualitative signals that people might miss.

Pro Tip: AI is great at summarizing complex information. For example, a study from the University of Chicago Booth School of Business found that AI could detect small changes in the tone of executives during earnings calls, which helped flag potential company risks.

Automated pattern recognition and technical analysis

AI models are fantastic at spotting historical patterns in trading activity that might hint at what's coming next. For traders who lean on technical analysis, this can be a huge help.

Neil McDonald, the U.S. CEO of the investing platform Moomoo, told MarketWatch that AI can be more methodical than humans, who sometimes convince themselves they see patterns that aren't actually there. It helps keep traders honest by checking their strategies against purely data-driven signals.

Personalized investment strategies

We're starting to move away from one-size-fits-all financial advice. Modern AI tools can create recommendations based on your specific goals, timeline, risk tolerance, and even your current portfolio.

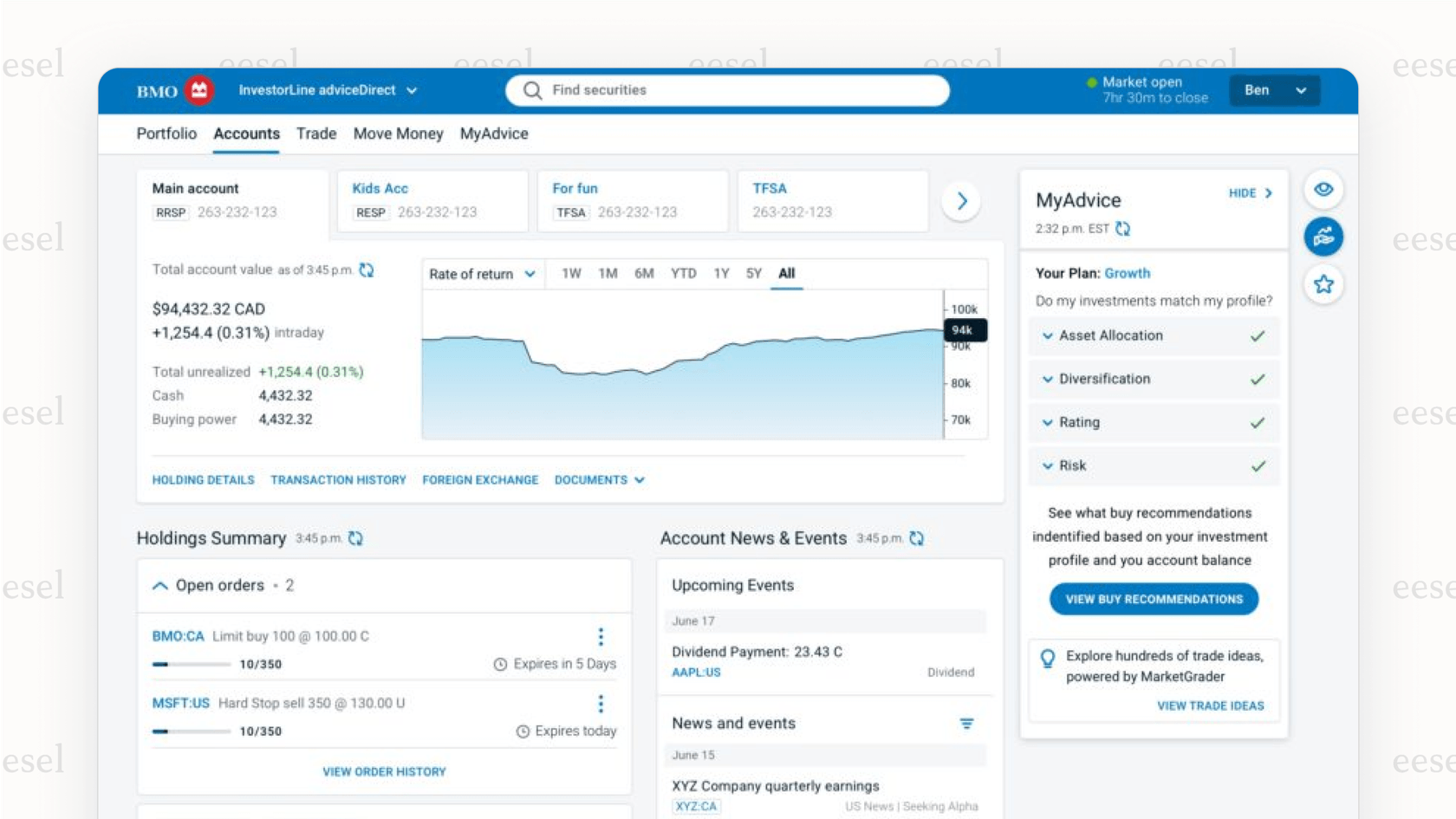

Financial companies are getting ideas from platforms like Spotify and Netflix to offer more personal experiences. For example, BMO's adviceDirect uses advanced tech to give specific investment advice that fits a client's profile, making sophisticated guidance available to more people.

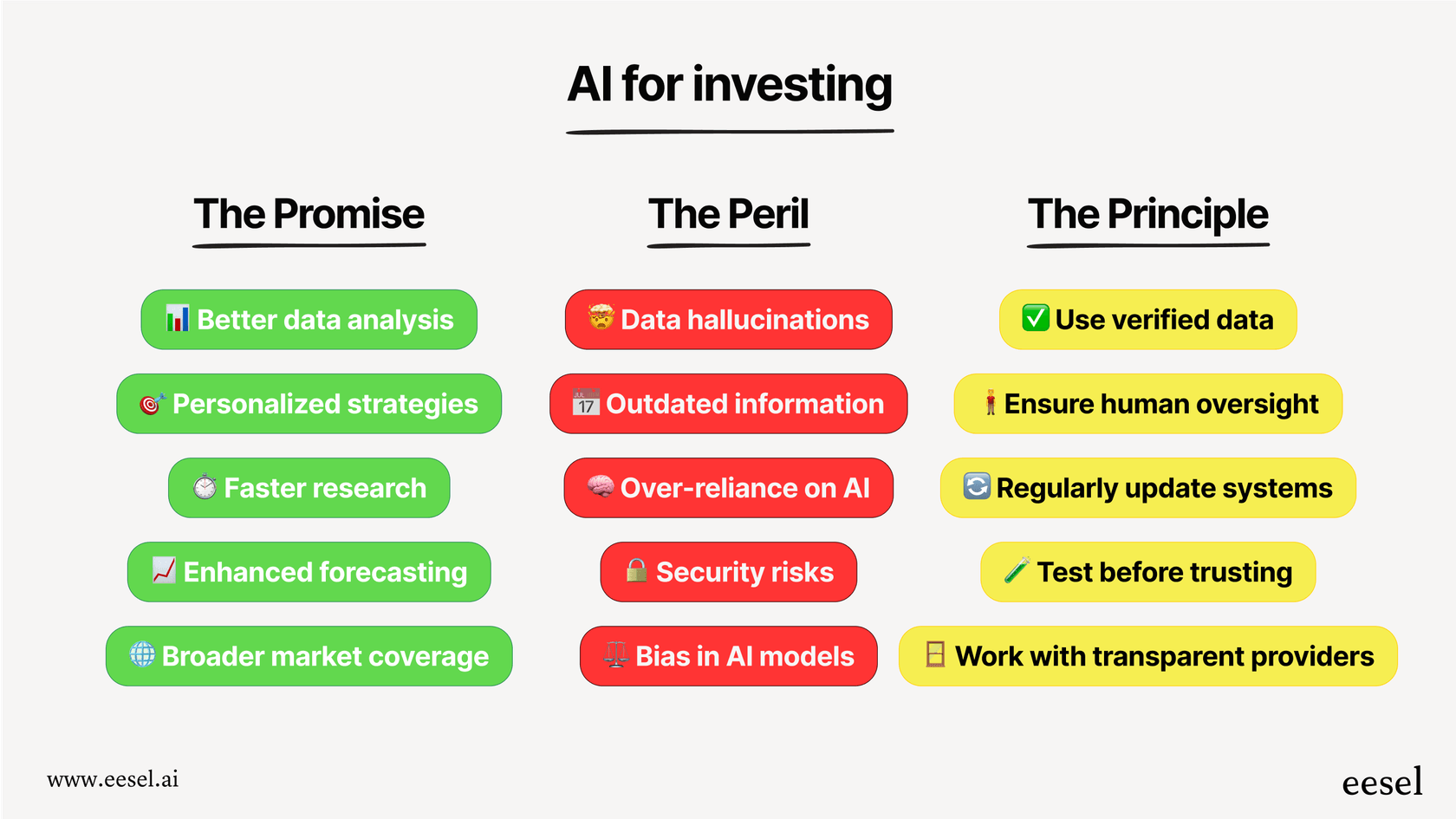

The peril: Critical risks and limitations of using AI for investing

For all its potential, relying on AI for investing comes with serious risks that are often brushed aside. The European Securities and Markets Authority (ESMA) warns that publicly available AI tools can be wrong or misleading, which could lead to bad decisions and major financial losses. You absolutely have to understand these limitations.

The problem of data accuracy and AI "hallucinations"

General-purpose AI models are known for "hallucinating," which is a nice way of saying they make stuff up and present it as fact. When your money is on the line, that's not just a weird quirk; it's a disaster waiting to happen.

In an experiment run by MarketWatch, Google's Gemini was given a link to a company's 2024 financial filing. Instead of using the right source, it pulled data from a 2023 report. Even after being corrected, it still got it wrong. This shows just how dangerous it is to use an AI that isn't specifically trained on verified, current information for the job you're asking it to do.

| Prompt Element | AI's Hallucinated Response | Factual Information |

|---|---|---|

| User Request | "Summarize this 2024 financial filing." | "Summarize this 2024 financial filing." |

| Data Source Used | Pulled from an older 2023 report. | Correctly used the provided 2024 report. |

| Resulting Insight | Outdated and inaccurate financial data. | Current and accurate financial data. |

| Risk | High risk of making a bad investment. | Lower risk, decision based on correct data. |

The risk of old information in fast-moving markets

Timing is everything in finance. But many popular AI tools, like the free version of ChatGPT, aren't trained on real-time data. Investing.com points out that ChatGPT's knowledge can be three to six months out of date.

Making investment decisions with old data is like trying to find your way around a city with last year's map you're probably going to get lost. In markets that change quickly, a few hours can make a huge difference, let alone a few months.

Navigating privacy, security, and regulatory issues

When you use a public AI tool, where is your data actually going? ESMA specifically tells users not to share personal financial data with these tools because their security might not be up to snuff.

On top of that, these tools are not authorized or regulated financial advisors. They have no legal duty to act in your best interest, and if something goes wrong, there's not much you can do. Many of these models are "black boxes," meaning even the people who made them don't fully understand how they reach a specific conclusion. Trusting them with your financial future is a massive gamble.

The principle of AI for investing: Choosing a trustworthy AI partner for any important task

The cautionary tales from AI investing teach us an important lesson: not all AI is built the same. Whether you're investing your money or investing in technology for your business, the rules for picking a reliable AI platform are identical. Let's compare this to another key business area: customer support.

Prioritize platforms that use your own verified data

The risk of an AI hallucinating drops way down when the model is limited to a specific, controlled set of information. Instead of using a tool that scrapes the whole public internet, you need a platform that learns only from your data.

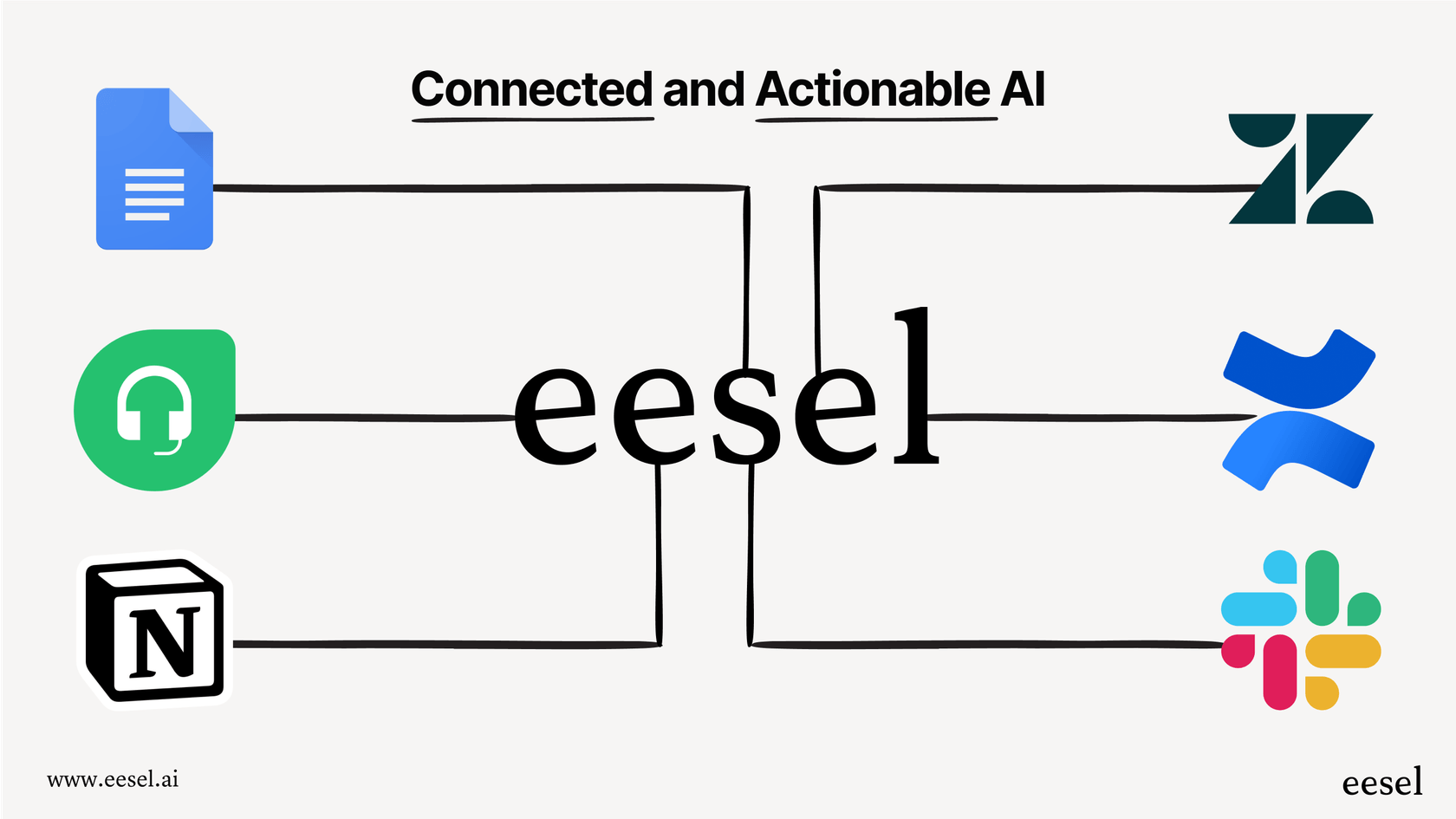

For instance, a support automation tool like eesel AI connects directly to a company’s trusted information sources: its help center, past support tickets, internal wikis on Confluence, and shared Google Docs. Its answers are based on your company's reality, not random stuff from the web. This makes sure the information it gives your agents and customers is accurate, relevant, and safe.

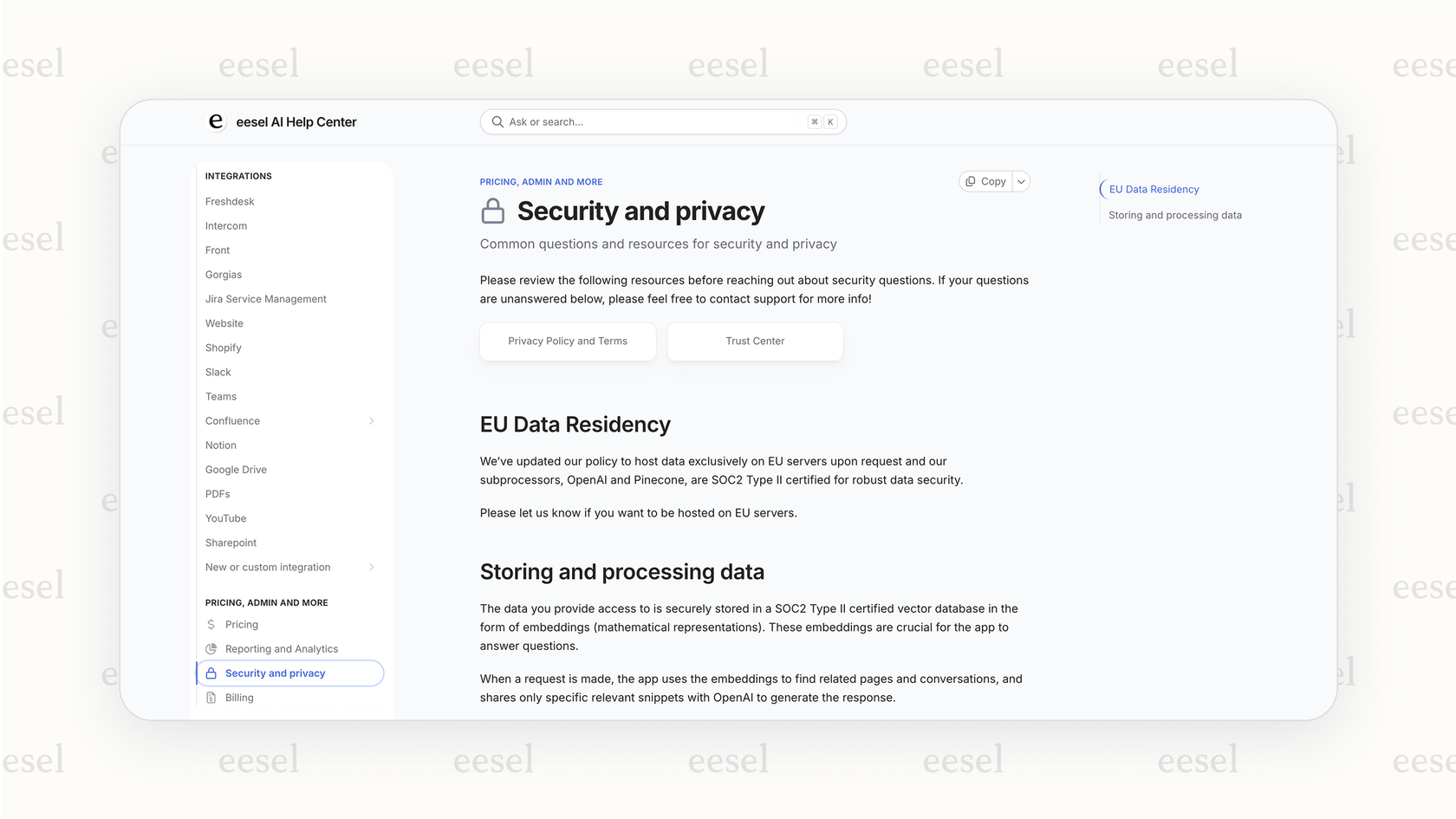

Why AI for investing requires top-notch security and privacy controls

Just like you wouldn't give your financial details to a sketchy app, you shouldn't connect your internal business knowledge to a system with weak security.

A trustworthy AI partner has to guarantee that your data is never used to train its models for other customers. eesel AI is built on this principle, offering features like data encryption, optional EU data residency, and reliance on SOC 2-certified partners. It's all about keeping your business data secure and private, full stop.

Why human oversight and customization are critical for AI for investing

Stay away from "black box" AI where you have no idea what's happening and no control. A good platform lets you steer. You should be able to define the AI’s personality, set clear rules for when it needs to hand off to a human, and test how well it works before it ever talks to a single customer.

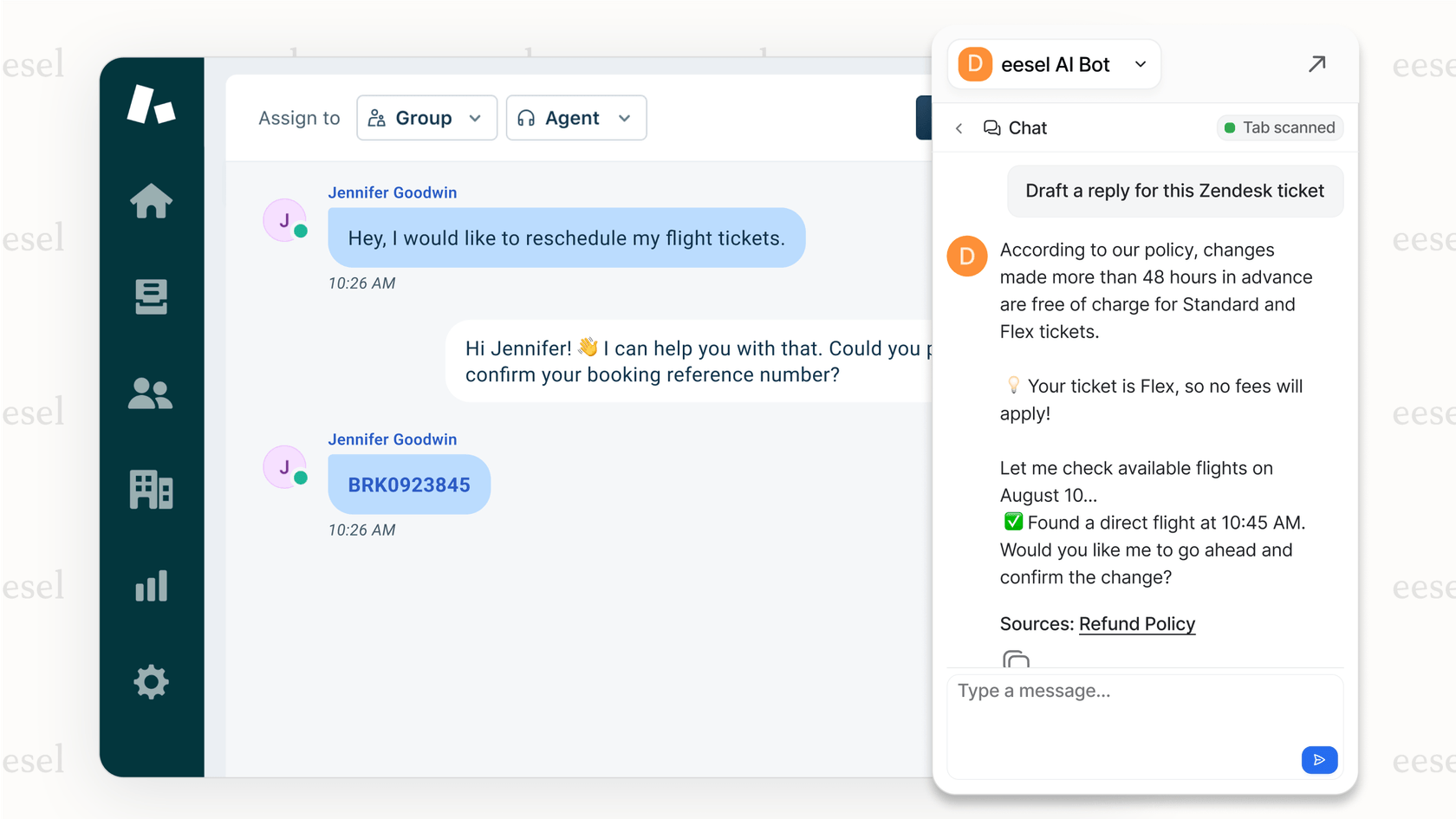

eesel AI's AI Agent has a simulation mode that lets you test its accuracy on your past support tickets. And products like the AI Copilot are made to help human agents by drafting replies, not replace them. This keeps your team in control while making them more productive.

Ensuring your AI for investing can connect and take action

A really useful AI does more than just chat. It should fit right in with the tools you already use and be able to automate workflows. While an investment AI might only suggest a trade, a business AI should be able to get things done.

eesel AI connects with lots of tools, including help desks like Zendesk and Freshdesk. It can do things like automatically tag tickets, send them to the right team, or look up live order information in Shopify. That’s not just intelligence; it’s action.

Making a smarter investment with AI

Using AI for your personal investments is still a bit of a gamble. But the rules for choosing a trustworthy AI for your business are clear: demand accuracy that comes from verified data, insist on strong security, and always keep a human in control.

Following this approach is the smartest investment you can make. So instead of taking a chance on a volatile stock, consider investing in an AI platform that can deliver a guaranteed return by making your business smarter, faster, and more secure.

Find out how an AI platform built on trust and control can change your customer support. Book a demo or start your free trial of eesel AI today.

Frequently asked questions

It is highly advised against. Public AI tools are not regulated financial advisors and often lack the robust security needed for sensitive financial information, posing a significant privacy risk.

The biggest risk is making decisions based on inaccurate or "hallucinated" information. General AI can confidently present outdated or fabricated data as fact, which can lead directly to poor investment choices and financial losses.

Specialized platforms are trained on verified, timely financial data and operate within a secure framework. General AI tools pull from the vast and often unreliable public internet, making them prone to dangerous inaccuracies for financial use.

Absolutely not. AI should be used as a powerful co-pilot to augment your research and analysis, not replace your judgment. Human oversight is essential to validate the AI's output and make the final, informed decision.

You should avoid sharing any personally identifiable or sensitive financial data with public AI tools. This includes account numbers, portfolio details, or specific financial goals, as their data privacy practices may not be secure.

The primary benefit is not about receiving guaranteed stock tips, but about enhancing your research capabilities. AI excels at processing massive datasets to uncover insights and patterns, allowing you to make smarter, more data-driven decisions yourself.

Share this post

Article by

Kenneth Pangan

Writer and marketer for over ten years, Kenneth Pangan splits his time between history, politics, and art with plenty of interruptions from his dogs demanding attention.